Unmatched data connectivity for households and businesses

Providing best connectivity

|

Our commitment

To offer best connectivity, both in mobile and fixed, regardless of geography of customers. To bring up to 1 million households within the reach of our fibre network in 2018. To further develop our LTE coverage and provide best connectivity experience on LTE.

|

|

Delivery on our commitments in 2018

Connectivity is a vital pillar of our strategy. As the demand grows

for greater quantities of data and higher speeds of transmission,

investing in the right spread of technologies and maintaining and

upgrading our network infrastructure helps to ensure that Orange

can continue to attract customers with the promise of fast and

reliable services. In 2018 we continued to concentrate our efforts

on fibre technology to keep pace with the demand for high-speed

broadband, and we improved the quality of our mobile 4G/LTE

network to accommodate the explosive growth of mobile data

traffic.

Fixed Line

A fast, modern and reliable network is a critical factor to success in convergence. Due to great differences in the competitive environment, the technological options related to population density, our market shares and customer needs, we use

a local approach in our activities, which varies in big cities,

medium to small towns and rural areas. In big cities we focus

on development of fibre coverage and recovery of market share

in fixed broadband by capitalising on our excellent position in

the mobile market; whereas in rural areas mobile technologies,

supplemented by fixed ones, are the primary broadband access solution.

In 2018, in line with our strategy, we continued massive development of fibre lines.

As at the end of 2018, almost 3.4 million

households were connectable with the fibre network, which is

an increase of over 900,000 compared to the end of 2017. Our

fibre services are available in 117 cities compared to 75 cities

at the end of 2017. In more than 50 cities, our fibre network reaches over 50% of all households. In 2018, we focused more

on developing our network in smaller towns, where some districts

are dominated by single-family houses. These accounted for

16% of the total network rollout. On one hand, it involves much

higher investments, but on the other hand, we expect much

higher demand for our services in single-family houses – despite

the fact that fibre broadband is more expensive for such customers.

Our fibre development strategy assumes wholesale agreements

with other fibre network operators, wherever it is technically

possible and economically viable. The main benefits include

quicker access to the fibre network and more efficient use of

the existing fibre infrastructure in the relevant locations. This is

in line with the aims of the Cost Directive of the European Commission, which recommends avoiding duplication of the existing facilities. Such agreements were concluded in 2016, 2017

and 2018. Under this scheme, we have been already using the

infrastructure of 32 operators for nearly 417,000 households.

The number of households connectable to Orange Polska’s

VDSL network stood at over 5.3 million at the end of 2018.

VDSL range increased only 2% as compared to 2017, mainly

because we gave priority to fibre network investments.

Orange Polska is Poland’s largest wholesale service provider.

Lines with capacity of 1 Gbps or more have been in particularly

great demand recently. In 2018, we continued to build nationwide OTN (Optical Transport Network) trunk lines in order to

enhance accessibility and reduce time to deliver leased lines

services. In 2018, we began to implement new high-capacity

nodes which will increase network flexibility. Our nationwide

OTN consists of 30 transport nodes in Poland’s biggest cities,

providing for an aggregate network capacity of 3.1 Tbps.

Mobile

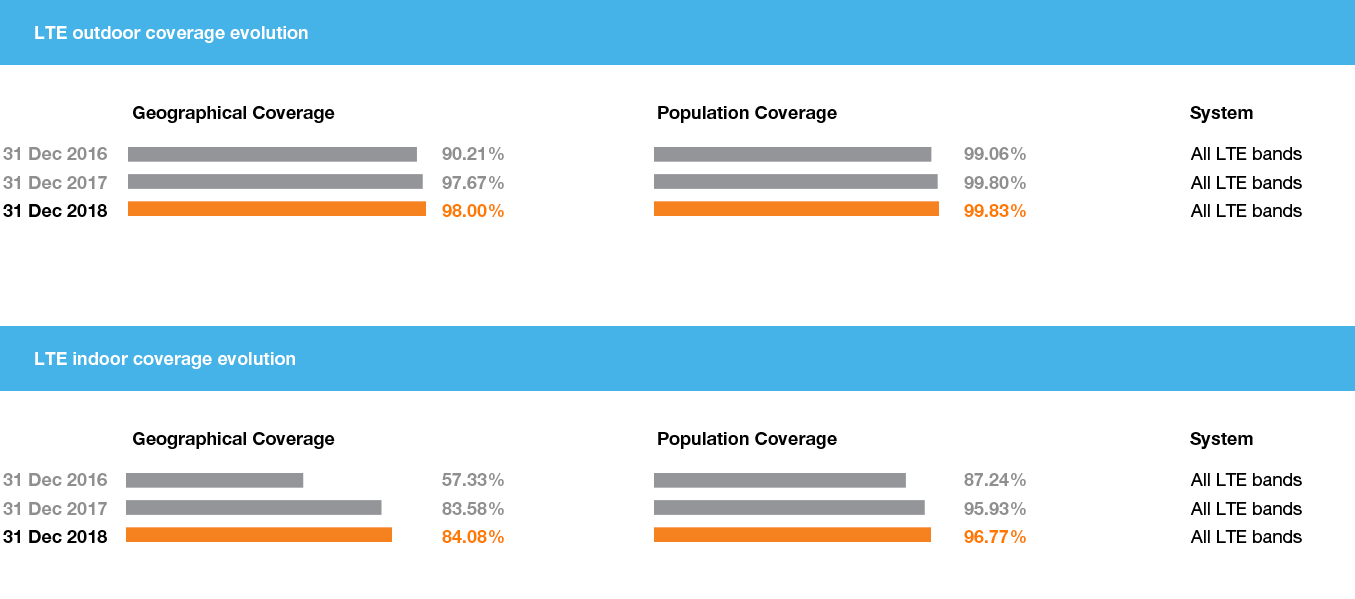

We have been gradually expanding our network coverage and

capacity. In 2018, our customers got access to further 355 base

stations. As data transfer on the Orange mobile network is growing

rapidly, with the biggest increase reported in 4G LTE traffic (which

grew 75% in 2018 year-on-year), LTE technology remains the top

investment priority in our mobile network. Thanks to our ongoing investments in the mobile network, 4G outdoor coverage for

all bands was 99.83% of the population on 98.00% of Poland’s

territory at the end of December 2018. We provided LTE services

via 10,882 base stations. In 2018, Orange Polska also focused

on increasing the number of sites that enable spectrum aggregation; their number reached 6,901 at the end of December 2018

compared to 3,916 a year earlier. As a significant portion of the

available spectrum was allocated to older technologies (2G and

3G), we decided that in addition to building new stations and

expanding our 4G LTE network based on the 800 MHz and 2600

MHz frequencies, we will also optimise the use of our frequency resources. The first change involves the conversion of the 15

MHz frequency block in the 1800 MHz band, which is used jointly

with T-Mobile, into two independent carriers of 10 MHz each.

This enables to increase the capacity of our 4G LTE network

within this band by approximately 1/3 in a short time. The second element of the spectrum refarming process will be to launch

LTE services in the 2100 MHz band. Orange Polska will use 10

MHz (currently allocated to 3G) for this purpose. Both changes

allow aggregation of up to four carrier bands, which translates

into higher network capacity and transfer speed. The total bandwidth allocated to LTE services will increase to 45 MHz. At the

same time, in order to maintain the quality of our 3G network, we

have also converted the 4.2 MHz frequency block used jointly

with T-Mobile for UMTS900 services into two independent carriers of 4.2 MHz each. The change in the spectrum usage in the

900 MHz band has been already effected, while the ones in the

1800 and 2100 MHz bands are being introduced gradually, and

by the end of 2018 had been completed in 11 cities (Cracow,

Toruń, Poznań, Bydgoszcz, Upper Silesian Conurbation, Tricity,

Olsztyn, Wrocław, Lublin, Szczecin and Warsaw). The whole

refarming project will take three years and will be completed

in 2020.

Delivering a palette of services adjusted to customer needs

|

Our commitment To offer a full palette of services, enriched by non-telco products, to strengthen our position as the unique convergent player in Poland.

|

|

Delivery on our commitments in 2018

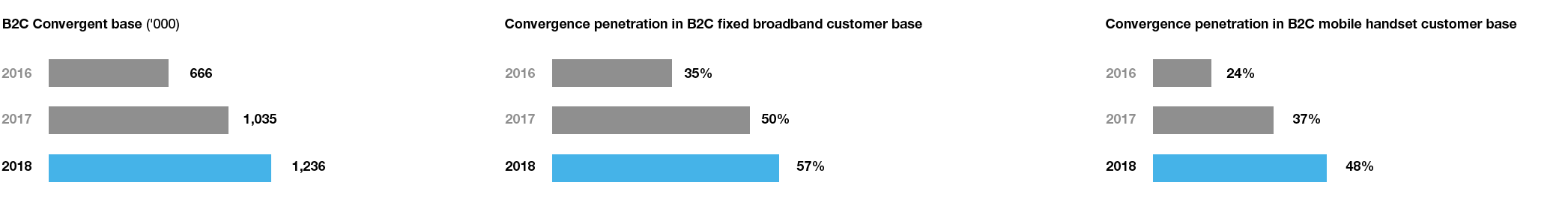

In 2018 we continued our commercial strategy, based on striking a balance between volume and value. Our commercial activity is focused on delivering a package of mobile and fixed services, which we define as convergence. It is our competitive edge, it constitutes a good customer loyalty tool and it allows us to upsell more services, winning a higher share of household media and telecom budgets.

Convergence addresses the household telecommunication needs and is a powertrain of our strategy

One of the key strategic objectives is to be the leader in telecommunication services sales to households. Convergence addresses household telecommunication needs in a comprehensive manner, increasing customer satisfaction and reducing churn (as churn rate is significantly lower than among single service users). Through our convergent offer, we are able to enter new households with our services as well as upsell additional services to households where we are already present, displacing competitors that cannot provide such a comprehensive offer.

In 2018, we continued sales of the Orange Love convergent offer, which is our flagship proposal for Polish households. It was introduced in February 2017 and its basic package includes:

- broadband access via either copper, fibre or wireless-for-fixed technology;

- a TV package of around 100 channels;

- mobile post-paid service with unlimited calls and SMSs plus a 5 GB data pool;

- and a home phone.

The offer is supplemented by a broad portfolio of smartphones, offered on instalment schemes. Sales remained high, despite the fact that huge growth in 2017 led to considerable saturation of our broadband customer base with convergent services. By the end of October, the Orange Love customer base exceeded 1 million. The majority of new mobile and fixed broadband service sales are now in the convergent bundle formula. Our convergent offer is a major competitive advantage over CATV operators, as they provide no or very limited mobile services.

In 2018, our B2C convergent customer base increased by 201,000 (or almost 20%), reaching just over 1.2 million. The total number of services we provided to these customers exceeded 5 million. On average, each convergent individual customer uses more than four Orange services, and this ratio is on a stable upward trend owing to upsell of additional mobile and TV services. The share of convergent customers in the aggregate base of residential customers of fixed broadband and mobile voice services has considerably increased, owing to the attractiveness of the Orange Love offer and the prioritisation of convergence at Orange Polska. Currently, 57% of B2C fixed broadband customers and 46% of B2C mobile handset customers have convergent bundles.

Mobile services: consistent implementation of a value-based commercial strategy

Following significant modifications of tariff plans in the autumn of 2017 (which involved mainly substantial simplification and reduction of the number of tariff plans), the changes we introduced in 2018 were aimed mainly at increasing the attractiveness of highend tariffs. In particular, such plans now include unlimited data transfer; once a dedicated data pool is used up, customers can still access the Internet, though the transfer rate is reduced to 1 Mbps. We also added pools of minutes for international calls in these tariff plans. As a result, our high-end tariffs gained an additional differentiator and became more attractive to customers, which raised their share in customer acquisition and retention. In addition, we introduced higher flexibility in combining various tariff plans in family offers.

In line with our value-based strategy, we continued to follow a policy of low handset subsidies, which was introduced in 2017. However, we introduced an option to purchase handsets in an instalment scheme at any time during the lifetime of the service contract. Before, customers could only buy a new smartphone on an instalment basis when concluding or renewing their contracts. Now, they can be much more flexible in this respect, which increases our competitiveness in the smartphone market versus other sales channels. We have thus addressed the needs of customers who either look for novelties or have lost their handset and need a new one. As a result, we have significantly increased smartphone sales and enhanced customer loyalty.

As at the end of December 2018, Orange Polska had a mobile services base of 14.8 million, which is an increase of nearly 3% versus the end of 2017.

In the post-paid segment, the number of SIM cards was up 2% year-on-year. Sales of handset offers increased by 3%. That is less than in 2017, as a result of the consistent implementation of a value-based commercial strategy and concentration on the Orange Love convergent offer in customer acquisition. As we expected, the number of mobile broadband services continued to fall due to increased popularity of mobile broadband for fixed use offers, as well as growing data pools for smartphones in mobile voice tariff plans. The number of SIM cards related to M2M services was still growing rapidly.

The pre-paid customer base increased by almost 4% in 2018, after a huge decline in the previous year (mainly due to a slump in new pre-paid activations following the registration obligation). The increase resulted from market stabilisation, as well as favourable changes in the service portfolio and effective communications that proved attractive to customers

Fixed broadband: the highest ever fibre customer growth underlines fibre’s competitive advantage and support it gives to convergence

Total fixed broadband customer base increased by 122,000 or 5% in 2018, reaching 2.6 million. The trend did not change compared to 2017. This growth is driven by an attractive convergent offer and investments in fibre and mobile networks. Decline in the mostly non-competitive ADSL technology was offset by growth in VDSL, fibre and wireless-for-fixed. The share of these growing technologies in the aggregate customer base increased to 55% at the end of December 2018 (from 46% at the end of 2017). We expect this transformation to continue as a result of the steady implementation of our convergence strategy and further investments in the fibre network.

Fibre customer base reached 366,000 and added 152,000 in 2018. Our non-convergent broadband customer base continued to shrink, as a result of migration to convergence but also due to churn.

As for the development of Orange TV services, 2018 saw the continuation of the convergence strategy, of which pay-TV is a major element, as well as further investments in quality 4K Ultra HD services. The take-up of Orange TV services has seen steady growth, reaching 943,000 (up 94,000 or 11% year-on-year).

In 2017, Orange Polska became the first nationwide operator to provide pay-TV content at 4K resolution. Since then, the 4K offer has been constantly expanded. In addition to two TV channels (Festival 4K and Eleven 4K) and 4K content provided by Netflix via Orange set-top boxes, in 2018 the Company introduced TVP 4K and Canal+ 4K channels during the 2018 FIFA World Cup and enhanced its video-on-demand catalogue of films and programmes from such providers as Discovery and Warner.

Fixed voice services: unfavourable trends continue

Erosion of the fixed voice customer base (excluding VoIP) totalled 431,000 in 2018 and was slightly higher than in 2017. The decline can be attributed mainly to structural demographic factors and the popularity of mobile services with unlimited calls to all networks. It is also a result of our convergence strategy, which stimulates partial migration of customers to VoIP. Revenue erosion was approximately 13.6%, remaining at a similar level to 2017. We expect this downward trend to continue in subsequent periods. A positive trend, however, is the stabilisation of average revenue per user.

Fixed broadband customer base (‘000)