Being responsible

Convergence

Connectivity – best for fixed and mobile

Convergent network

Customers want fast, reliable and safe broadband access, and

from their point of view the technology by which the service is

delivered is less important. It is our strongly held opinion that

fulfilling customer needs requires first-class connectivity in both

mobile and fixed. Mobile alone will not be sufficient. Fast fixed

broadband is necessary to address the data demands of

streaming services and heavier and heavier traffic, and at the

same time to provide a desirable customer experience on the

mobile network. In addition, a substantial part of our operations is

dedicated to serving business customers who specifically cannot

rely on mobile technology alone.

Fixed – from legacy to future proof fibre

In 2015 we made a strategic decision to invest on a large scale in

the deployment of a fibre to the home (FTTH) network. It is structurally improving our competitive position and gives us leverage

to win back market share in densely populated areas. It also constitutes an important lever for our convergent strategy and one of

the key enablers of our turnaround ambition.

We have completed four years of investments, bringing almost

3.4 million households within the range of the service at the end

of 2018. We are on track to reach our goal of more than 5 million households covered by the end of 2020. That number would

include the vast majority of households in big cities and also a

significant proportion of smaller cities. It also includes around

370,000 households in more rural areas, where fibre access is

covered by the government POPC programme subsidised by EU

funds.

The strategy of FTTH network rollout provides not only for the

construction of our own infrastructure but also for wholesale

agreements with other fibre network operators, where it is technically possible and economically viable. At the end of 2018 our

network coverage included more than 400,000 households via

the infrastructure of other operators.

In 2018 we covered around 900,000 additional households,

broadly maintaining the very fast pace of deployment from the

previous year. We plan to maintain this pace in 2019. Last year

we focused on smaller cities and also on single-family houses as

opposed to multi-family residences. Single-family houses constituted around 17% of total deployment in 2018. On one hand,

single-family houses carry a much higher construction cost; on

the other hand, we notice far higher demand for our services due

to much lower competition.

To explore new opportunities and to better monetise our fibre

investment, in 2018 we signed an agreement with T-Mobile granting

wholesale access to our fibre network. The agreement covers ca.

1.7 million households located in deregulated zones, with access

points built in multi-family residences on Orange Polska’s own

infrastructure. The wholesale cooperation will contribute to faster

monetisation of our investments in the fibre network, maximise

usage of our infrastructure while avoiding fibre network overbuilding by other operators and accelerate convergence of telecom

services in the Polish market based on fibre. The agreement is

not exclusive. We maintain the right to offer the same terms of

wholesale access to our fibre network to other operators.

We closely monitor our fibre network rollout with respect to

monetisation: the number of customers and the value they bring.

This depends mainly on the level of competition and our sales

effectiveness. Investment in fibre is by nature long term, but in

our view this is future-proof technology, the parameters of which

can easily be upgraded if necessary. In particular, in 2018 we

started to offer broadband speeds of 1GB/s on our fibre network.

The highest speed previously available was 600 MB/s. Higher

speeds (300MB/s and 1GB/s) incur additional charges (PLN 10

and PLN 30 a month, respectively). We also charge customers in

single-family houses PLN 15 a month more to recover the higher

deployment costs.

Mobile – more spectrum on LTE

Mobile data traffic growth continues to be very robust. In total,

traffic on our mobile network grew by more than 50% in 2018.

To address this demand we continually invest in the quality of

our network. By the end of 2018 our 4G/LTE mobile network

reached almost the entire Polish population on an outdoor basis

and 97% indoors. To accommodate robust growth of demand

for LTE traffic, in 2018 we focused on refarming the spectrum

to allocate more for this technology and decrease the allocation

for both 2G and 3G. This will allow us to use spectrum in a much

more efficient manner and improve the customer experience. In

2018 we completed refarming on the 900 MHz spectrum and we

are well advanced on 1800 MHz. Refarming will continue in 2019

and 2020.

In the years to come 5G technology will become another important element of our mobile connectivity strategy. This will involve allocation of new spectrum, particularly in the 3.4-3.8 GHz band and 700 MHz. Exactly when and how this spectrum will be allocated is in the hands of UKE, and is not certain at the moment. However, for now it appears that allocation of some spectrum in the 3.4-3.8 GHz band will be possible much sooner (perhaps as soon as 2020) than in 700 MHz.

Mobile and fixed data consumption (PB)

Connectivity

Improving

customer experience

Convergence – consolidating households’ telecom and media spending

We define ‘convergence’ as delivering a package of both mobile

and fixed services, which fulfils the needs of an average household. In our view there is a significant potential for convergence

in Poland as the vast majority of households still pay their media

and telecom bills to different operators. Consolidation of these

bills comes with both convenience and a financial benefit. We

know from the example of some European markets (Spain or

France) that convergence can be a winning commercial formula.

In line with our value-focused approach we made convergence

our flagship product for Polish households. At the same time we

limited advertising of our mobile-only or fixed-only offers.

Convergence gives us the following key benefits:

- It constitutes our competitive edge, a key market differentiator. On one hand, cable operators do not offer mobile services on any meaningful scale. On the other hand, our mobile competitors historically did not invest significantly in fixed access networks. That is now changing, with the acquisition of Netia by Cyfrowy Polsat and T-Mobile gaining access to our fibre network. However, our footprint to offer convergence on a fibre network is by far the largest in the market, and we believe Orange Love, as the only hard bundle offer, is a unique value proposition for Polish consumers.

- It is a good customer loyalty tool. Convergent customers tend to churn a lot less than non-convergent customers.

- It allows us to upsell more services, winning a higher share of household media and telecom budgets.

Our Orange Love convergent offer continued to be our flagship proposal for Polish households in 2018. In October we passed the milestone of 1 million customers, just 19 months after launching. The total number of convergent customers increased 20% last year to more than 1.2 million. The Orange Love offer is a predefined set of fixed and mobile services, bundled together and sold at an attractive fixed price. The basic package can be extended with extra fees for additional SIM cards, higher fibre broadband speed and additional TV content. On top of that we offer a wide range of smartphones at attractive prices. Importantly, Orange Love is available on any broadband technology (fibre and copper), and also on LTE positioned as home broadband. This allows us to market this offer all over the country, which is very efficient. In March 2019 we refreshed the Orange Love offer. We designed two new packages called Extra and Premium to make the choice easier for customers looking for richer TV content.

TV content – an important success factor

An important factor in the success of our convergent strategy is the quality of TV content, which is very important for Polish consumers when choosing a service provider. In 2016 we changed the way we source our TV content, both on IPTV and satellite technology. It allowed us to be more flexible in the way we shape our offer and price it. In 2017 we became the first operator in Poland to launch a decoder that allows customers to watch 4K Ultra HD TV. Our TV offer is now fully competitive versus cable operators, allowing us to successfully build Orange’s reputation as a reliable content provider. We intend to remain a content reseller: our strategy does not foresee any investments in exclusive content.

Convergence

Increasing our

efficiency

Improving customer experience - towards digitalisation and a more friendly approach

Building positive customer experiences

The customer is at the centre of everything we do. Therefore,

we focus on building positive customer experiences as well as

developing strong, long-term relationships, using modern digital

channels.

From product portfolio development and process planning to the

right mix of contact channels, we unite all our employees around

the common goal of providing Orange customers with a unique

experience.

For several years we have been assessing our customers’ experiences with the NPS (Net Promoter Score) performance indicator,

which is a measure of the loyalty of our customers and the quality

of our relationships with them. Our NPS is increasing gradually,

which vindicates our intensive focus on customers in all our

activities. At the end of 2018 we had the second highest score in

the market, but we took third position overall as there were two

operators ranked first equal at the end of 2018.

Approach driven by customer journeys

In 2017, we implemented an approach driven by customer journeys in order to allow comprehensive customer experience management. It is based on a customer journey map, which is the

starting point for developing customer excellence.

In 2018, we focused on designing new and enhancing existing

customer experiences at each stage of the customer journeys.

This resulted in a significant increase in the number of issues

resolved by customers on their own via digital and automated

contact channels, as well as a drop of 20 percentage points in

issues reported by phone.

In 2018, we implemented a number of solutions which improved

customer satisfaction and minimised effort through simplification,

automation and digitalisation of customer relations with Orange.

These included:

- Automation of customer care processes – This is a global trend and Orange is its leader in Poland. Further automation of customer care processes and implementation of innovative automated solutions (a bot/robot combination in the customer care process) have cut costs and improved operational efficiency by reducing time to complete, enhancing service quality and eliminating errors in business operations.

-

Chatbot – We expanded the scope of assistance. On our orange.

pl website, customers can chat with a bot to resolve issues in

the following areas:

– Technical support for fixed-line services;

– Roaming and international calls;

– Payment handling. - SIM – We were the first operator in the Polish market to introduce embedded SIM (eSIM) cards. Our customers can manage their eSIM cards themselves using our new ‘My Orange’ app.

- Videocall – In 39 sales outlets, our customers can talk to a consultant online about service issues. In 2018, our customers made over 26,000 such calls.

- We have simplified the invoice layout for fixed-line customers; similar simplification for other customers is still ahead of us.

- Within the offer introduction process at Orange, we have implemented a standard which takes the customer’s perspective into account in all customer journeys.

Our entire organisation, from line employees to the Management Board, has been involved in reinforcing our customer-centric culture. Each key decision is considered in terms of customer benefits. The senior management regularly reviews customer satisfaction surveys, identifying the necessary actions. Such review meetings are always attended by special guests: customers who tell us about their experience with Orange. Furthermore, all managers and selected experts regularly call customers who expressed their discontent in satisfaction surveys. An additional support is provided by an internal e-platform launched in April 2018, which is used for sharing knowledge and ideas on customer experience improvements. As a result, all employees can contribute and raise their innovative voice in public. Our employees are also offered a chance to work in multi-function teams on projects aimed at improving customer experience.

Digitalisation: An increasingly important trend for our customers

Digital transformation plays an increasing role in all spheres of our customers’ lives, and this is also the direction in which we are developing. In Poland today, more than half the population uses social media, 34% shop online and more than 50% use internet banking services. Solutions such as app-only services (without a web interface), mobile shopping experiences or customer care via in-app chat or bots are increasingly widespread. Digital services aim to serve a customer at the moment the need arises, giving them freedom to choose, change, or cancel the service. And by enabling highly personalised offers, digital services create a totally new level of company-customer interaction. Adoption of this trend is strongest among the younger generation: they are early adopters of digital solutions, who actively engage with the brands they love, but also have high service expectations. At the same time, the digital world is seamlessly integrating with the traditional/offline world; the trend is towards an omni-channel approach, where online empowers offline with the ROPO effect (“research online, purchase offline”) and vice versa.

Improving

customer experience

Being responsible

Increasing our efficiency

Facing very high competition, ongoing pressure on our top line

and the still significant burden of our legacy, our strategy puts a lot

of emphasis on improving our efficiency on the cost and capital

expenditures side. This area has been given new emphasis

with the Orange.one strategy, which puts particular focus on value in all aspects of our activities. Our ambition is to be an agile

company, digital and flexible, with a strong online presence and

highly automated processes, as well as a proven ability to cut

costs and find efficiency savings.

Direct profitability to benefit from value focus

With Orange.one we redefined our commercial approach. It is

now much more balanced between volume and value. Orange

Love convergent offers allow us to distinguish ourselves from

the competition and reach our commercial goals more efficiently.

We have significantly reduced handset subsidies and optimised

our distribution channel mix, which is allowing us to improve

direct profitability. To facilitate higher value generation we have

simplified and aligned our commercial offers, both convergent

and mono, around a ‘more for more’ approach, cutting down on

value-dilutive offers and introducing charges for every additional

service. Such a strategy assumes that the level of market competition remains high, but that competition will gradually be shifting

from one based on price to one based on quality of the offer and

customer service.

Transformation of processes

Our business model is a chain of interconnected processes that

allow us to render our services. These processes are usually

complex, which is partly attributed to the incumbent operator

status of Orange Polska. Within the framework of Orange.one

implementation we have introduced a comprehensive transformation program to simplify, and where possible to automate and

digitalise these processes. As a result, we realise savings in operating costs and capital expenditures.

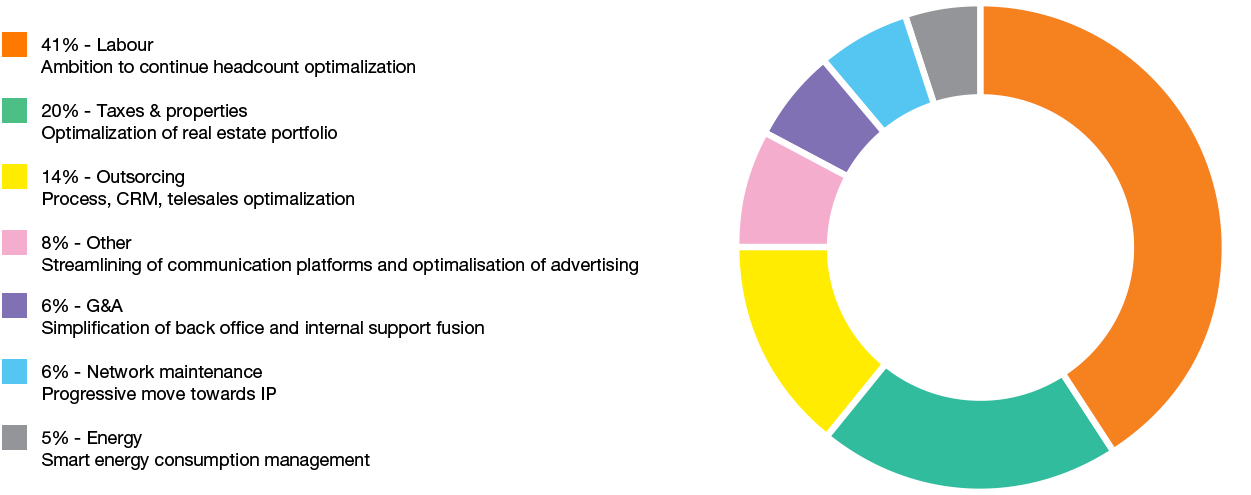

Ongoing indirect cost optimisations with clear target to reach

We have been optimising our indirect operating costs for many

years, generating hundreds of millions in savings every year. We

continue to do this under the Orange.one strategy. The savings

come from the above-mentioned process improvements, which

free up resources, as well as from volume optimisations and simplification. We are more focused and more selective in resource

consumption. We tackle all cost categories presented in the chart

below. As one of our Orange.one financial ambitions we committed to a 12-15% reduction of this cost pool (which amounts to

around PLN 4 billion) between 2016 and 2020. This figure is net of

potential increases related to inflation, pressure on labour costs

and costs related to new business development. We reached this

target 2 years in advance: in 2018 our indirect costs were 14%

lower compared to 2016.

The largest cost category, and at the same time the most important source of savings, is labour. Over the past five years (2013-

2018) we have optimised our employment by around a third and

we aim to continue. The scale of reductions is always negotiated

with our social partners (there are 17 trade unions at Orange Polska). The social plan currently in force, signed in December 2017

and covering the years 2018-2019, constitutes an acceleration

of employment optimisation. According to the plan up to 2,680

employees may opt for voluntary departures in these two years,

which constitutes 18% of the total workforce at the end of 2017.

In 2018 1,450 people left the company within the framework of

this social plan. In 2019 up to 1,230 employees of Orange Polska

S.A. will be eligible for the voluntary departure package.

Indirect cost optimisations also include gains on sale of real

estate. We have a large portfolio of real estate, mainly because

of our long history. In the past we needed many more locations

for our employees and our infrastructure. We are gradually consolidating office locations and optimising space for infrastructure. This process is supported by technological progress and

changes in our business model. As a result, we are able to free up

resources and sell unused real estate. This is a clear example of

our discipline in capital reallocation: we are moving capital away

from real estate into our fibre network deployment programme,

which provides much better long term returns for the company.

Split of indirect costs for 12 months (through June 2017)*

*As presented in September 2017 during Orange.one strategy announcement

Increasing our

efficiency

Connectivity

Being responsible

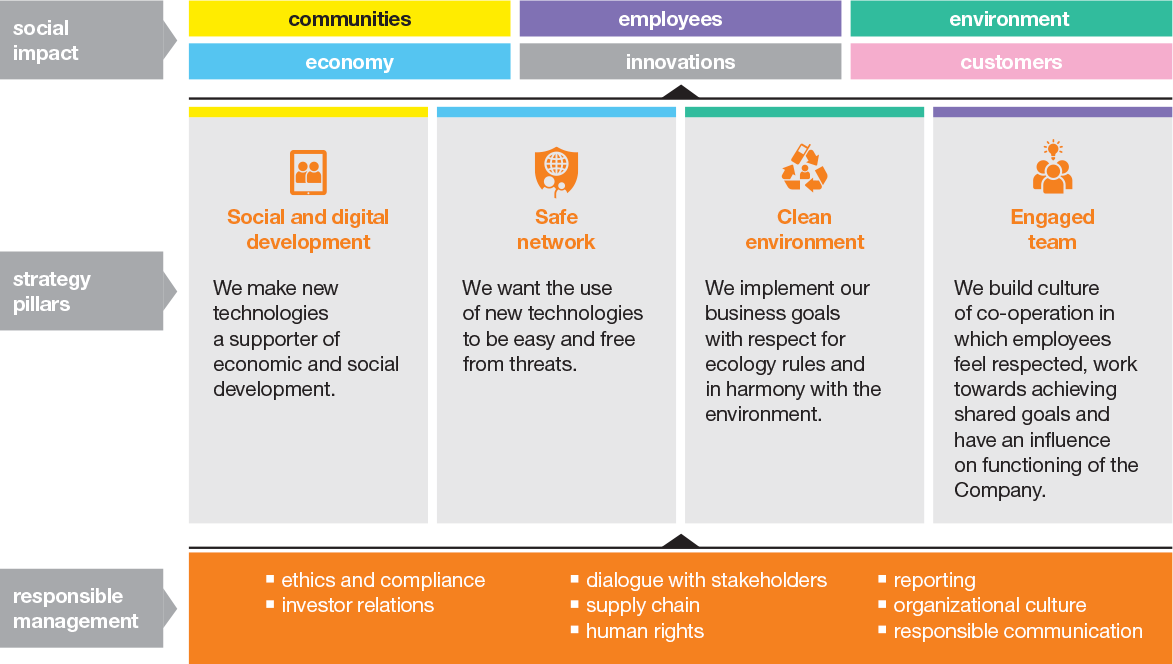

In Orange Polska, we have been successfully implementing a policy of corporate business responsibility in all areas of our business for several years now. Our CSR strategy accounts for the company’s business objectives and fits into their implementation. The conclusions from a dialogue with stakeholders as well as market trends and social challenges for our industry in Poland and abroad have been key elements in its development. For us, social responsibility means an organizational culture which takes account of the expectations of employees and other stakeholder groups – customers, investors, suppliers, business and social partners as well as the environment – in creating and implementing our business strategy. We believe that such an approach generates benefits for the company and its environment, leads to long-term development and contributes to the improvement of everyone’s lives. Therefore, in Orange Polska we have created a social responsibility strategy which focuses on five areas which are of key importance from the point of view of our sector and our operations on the Polish market. In 2016 we launched the new CSR strategy for 2016-2020. It was updated in 2018. A strong foundation of this strategy is responsible management – our values, ethics and compliance and our dialogue with stakeholders as a tool for understanding their expectations. On this foundation are based four pillars of our CSR strategy

- Social and digital development – We make new technologies an ally to economic and social development.

- Safe network - for the use of the latest technologies to be easy and risk-free

- Clean environment - to pursue our business objectives with respect for ecological principles and in harmony with the environment

- Engaged team – We build culture of co-operation in which employees feel respected, work towards achieving shared goals and have an influence on functioning of the Company.