|

|

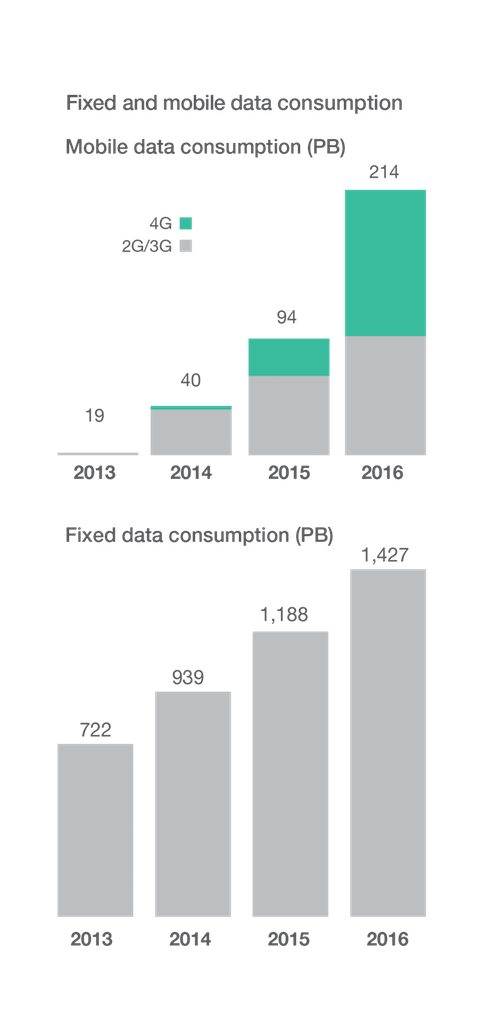

It’s all about data

While voice and messaging continue to be very

important for our business, it is quality of data connectivity that has become the key criterion in selecting

a telecom service provider. This is because as the

world is becoming more and more digital, customer

needs are evolving and the number of smartphones

and other connected devices is rapidly rising. As a

consequence mobile but also fixed data consumption continues to grow very fast and that trend is

expected to continue in the years ahead.

|

|

|

Convergent network

Customers want fast, reliable and safe broadband

access, and from their point of view the technology

by which the service is delivered is less important. It is

our strongly-held opinion that fulfilling customer needs

requires both first class mobile and fixed connectivity.

Mobile only will not be sufficient. Fast fixed broadband is necessary to digest future demand for data

driven by heavier and heavier traffic and demand for

streaming, and at the same time to provide a desirable

customer experience on mobile network. In addition,

a substantial part of our operations is dedicated to

business customers who specifically cannot rely only

on mobile technology.

|

|

|

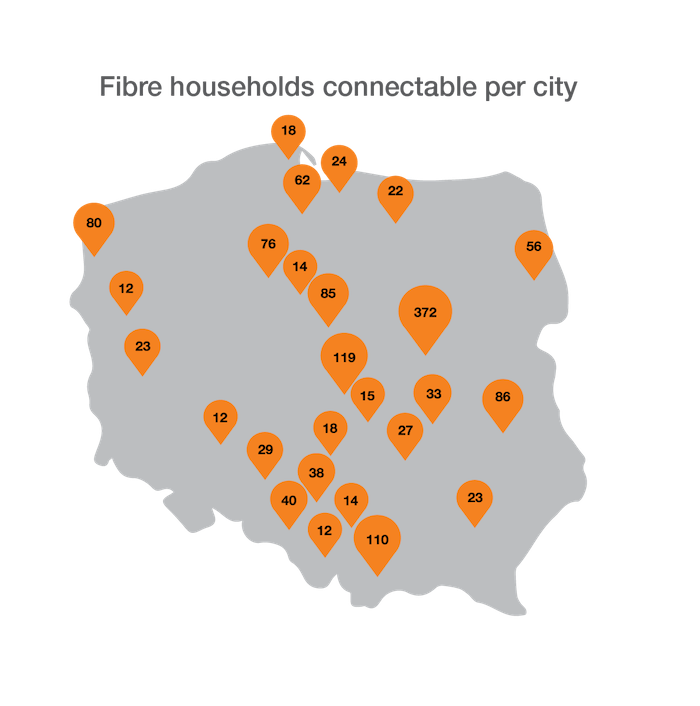

Local approach

Our connectivity strategy takes careful account of

differences in local markets. Polish households are

split roughly equally between big cities, small cities and

rural areas. Each of these zones is different, mainly with

respect to the competitive environment, our market

shares in particular segments and connectivity options.

In big cities our connectivity strategy will be concentrated around fixed, where our market shares have

eroded in the past years and where our approach has

to be offensive. In rural areas, the main connectivity

option is mobile technology. Fixed technologies will

be developed more opportunistically. A good example

will be the deployment of fibre technology using EU

subsidies in the government POPC programme. In

small cities, the situation is much less homogenous,

and connectivity development is based on the mix of

fixed and mobile.

|

|

|

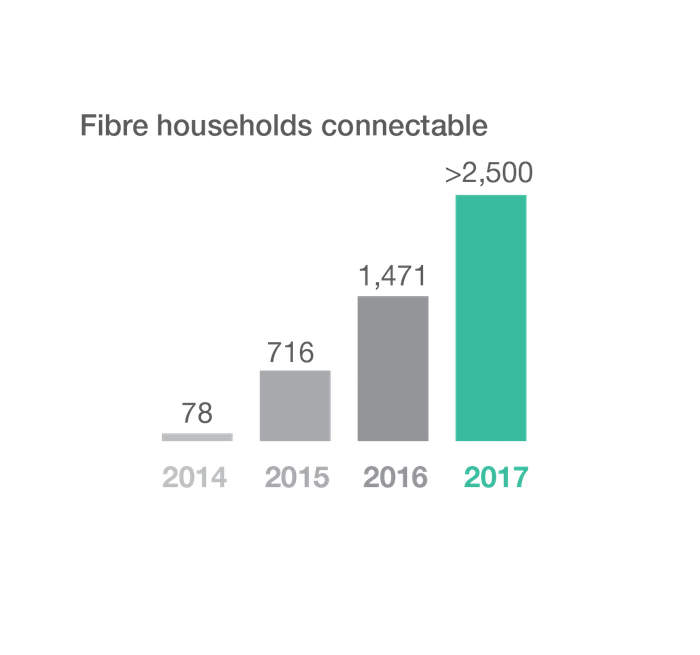

Fixed – from legacy to future-proof fibre

The majority of our fixed broadband network is based

on ADSL technology, which does not provide a desirable customer experience and therefore is not competitive. For the past few years we have been developing

VDSL technology, but this alone is not sufficient to

close the technology gap to cable companies, our key

competitors in the fixed broadband market. To change

that in 2015 we made a strategic decision to invest on

a large scale in the deployment of a fibre to the home

(FTTH) network, which will structurally improve our

competitive position and give us the leverage to win

back market share in densely populated areas. This

investment is concentrated largely in big cities but also more selectively in medium and small cities.

In 2015-2016 we invested around PLN 850 million

is fibre network deployment, covering almost 1.5

million households in 37 cities. This already makes

ours the largest fibre network in Poland.

In 2017 we plan to accelerate and cover more than

1 million new households. Total capex for 2017

is envisaged at around PLN 800 million. We will

most likely maintain this fast pace of fibre network

deployment for some time beyond 2017. Exact

plans are being updated at the moment and will be

presented later in the year. The rollout will be very

closely monitored with respect to the monetisation

i.e. number of customers and value they bring.

This depends mainly on level of competition and

our sales effectiveness. Investment in fibre is by

its nature long term, but in our view this is future

proof technology, the parameters of which may be

easily upgraded in the future if needed.

|

|

|

Mobile – fast deployment following spectrum auction

Our strategic position in the mobile market improved

significantly following the 800MHz and 2600MHz

spectrum auction that finished in October 2015.

Although very expensive, purchase of two blocks

of 800MHz was absolutely necessary for us to be

able to offer a competitive service and compete in

rural areas. By the end of 2016 our 4G/LTE mobile

network reached almost the entire Polish population

on an outdoor basis and 87% on indoor. From 2017

we will further invest in the area coverage, mainly

on 800MHz; selectively densify the network; and

strengthen network capacity, investing in 2600MHz

to proliferate more spectrum aggregation and increase speed to customers. According to independent source speedtest.pl, our mobile network was

the fastest in Poland in 2016.

|

|

|

Convergence – our key market differentiator

In the section above we described how our

connectivity strategy will adapt to the specifics

of local markets. Our commercial approach also

takes this into consideration; however, there is

a common denominator in all the zones, which

is service convergence. Convergence we define

as delivering a package of both mobile and

fixed services.

Convergence gives us the following key benefits:

-

It constitutes our competitive edge, a key

market differentiator that we intend to take

even more advantage of in the future. On one

hand cable operators do not offer mobile services on any meaningful scale. On the other

hand our mobile competitors do not invest in

fixed access networks. We use this advantage not only in the consumer market but

also in the case of small business customers.

-

It is a good customer loyalty tool. Convergent customers tend to churn a lot less than non-convergent customers.

-

It allows us to win a higher share of household media and telecom budgets.

Convergence appears to have been a very effective

tool for customer acquisition when it comes to

fibre technology. By the end of 2016 more than

50% of our fibre customers were also using our

mobile services in convergent packages.

|

|

|

TV content – an important success factor

An important factor in the success of our convergent strategy is the quality of TV content, which

is very important for Polish consumers when

choosing a service provider. In 2016 we changed

the way we source our TV conten t both on IPTV

and satellite technology. It allowed us to be more

flexible in the way we shape our offer and price it.

In 2017 we became the first operator in Poland

to launch a decoder that allows customers to

watch 4K Ultra HD TV. We intend to remain a

content reseller: our strategy does not foresee

any significant investments in exclusive content.

|

|

|

Orange Love – a new convergent formula

We have pursued a convergent strategy for

few years now. However at the start of 2017

we changed the formula. The previous formula,

which we called Orange Open, we based on a

pick-and-mix concept. Customers could get a

discount on the price of any additional service

purchased from us. With market development

this concept largely lost its competitive edge.

In February 2017 we replaced it with the Orange Love offer: a predefined set of fixed and

mobile services bundled together and sold at

an attractive fixed price. The basic package

can be extended with extra fees for additional

SIM cards, higher fibre broadband speed and

additional TV content. Importantly, Orange

Love is available on any broadband technology

(fibre and copper) and also on LTE positioned

as home broadband.

|

|

|

Improving customer experience – towards a more friendly approach

Our strategic goal is to become the most frequently

recommended telecom operator in Poland by 2020.

We want to provide an effortless and friendly customer experience along the entire customer journey,

for every point of contact, every customer interaction

(with the quality of network, product, website, service, content, employee, message, call centre).

Building trust and loyalty among our customers and

giving them what they want is vital to our sustainability in an increasingly competitive industry. Differentiating our service and products is key as we

want our customers to recommend us to others.

More access to mobile services and better network

quality, more value for money and simpler pricing structures, more convenient interactions: all of

these add up to better customer experience.

We listen to our customers to identify and eliminate

the reasons for their dissatisfaction. We simplify our

portfolios and processes. We get customers actively involved in a dialogue with us through:

-

studies comparing our portfolio, products and connectivity vs. our competition;

-

post-contact satisfaction surveys;

-

managers’ commitment to ‘In the Front Line’ initiative;

-

debates with the Management Board Members aimed to better understand the customer perspective.

Customer Experience issues are discussed

on an ongoing basis. At Orange Polska we

have a dedicated Customer Experience

Committee within our Management Board

and Executive Directors which is devoted

to Customer Experience improvement. This

committee meets on a monthly basis to reinforce the focus on customers. Key directors

(reporting directly to Management Board or

Executive Directors) meet on a weekly basis.

Our Management Board includes a member

responsible for Customer Care and Customer

Excellence.

|

|

|

Approach driven by customer journeys

Our goal is to make all customer journeys as

simple as possible by eliminating unnecessary pain-points and procedures – a goal that

depends not only on big initiatives but mostly on the implementation of numerous small

actions. Over the past two years we made

big progress in improving our net promoter

score (NPS). At the end of 2016 it reached

an all-time high as a result of significant improvements in satisfaction among our mobile

customers, on both B2C and B2B markets.

We want to make further gains in this direction in 2017. Right now, we are making big

changes in the way we manage the customer experience. Our approach going forward

will be driven by customer journeys (different

types of experience, such as purchase, payment, termination or help) instead of distribution channels. This will allow us to provide a

standardised and coherent quality of service

across all customer touchpoints.

|

|

|

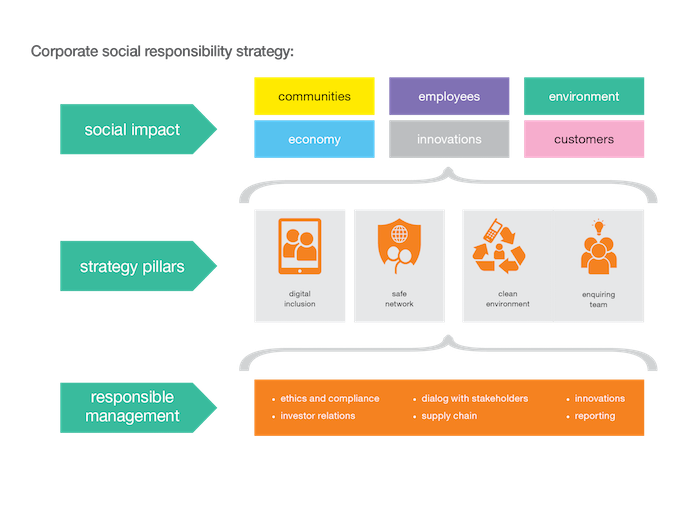

In Orange Polska, we have been successfully implementing a policy of corporate business responsibility

in all areas of our business for several years now. Our

CSR strategy accounts for the company’s business

objectives and fits into their implementation.

The conclusions from a dialogue with stakeholders

as well as market trends and social challenges for

our industry in Poland and abroad have been key

elements in its development.

For us, social responsibility means an organisational

culture which takes account of the expectations of

employees and other stakeholder groups – customers, investors, suppliers, business and social

partners as well as the environment – in creating

and implementing our business strategy.

We believe that such an approach generates benefits for the company and its environment, leads

to long-term development and contributes to the

improvement of everyone’s lives. Therefore, in

Orange Polska we have created a social responsibility

strategy which focuses on five areas which are of

key importance from the point of view of our sector

and our operations on the Polish market. In 2016

we launched the new CSR strategy for 2016-2020

A strong foundation of this strategy is responsible

management – our values, ethics and compliance

and our dialogue with stakeholders as a tool for

understanding their expectations.

On this foundation are based four pillars of our

CSR strategy:

-

Digital inclusion- for everyone, regardless of their skills, residence, age or ability, to be able to make use of the opportunities offered by the digital world

-

Safe network- for the use of the latest technologies to be easy and risk-free

-

Clean environment - to pursue our business objectives with respect for ecological principles and in harmony with the environment

-

Enquiring team - to create a culture of co-operation, in which all employees feel respected and can freely pursue their professional goals and life passions.

Responsible management and actions within

these four pillars account for our social impact,

which is analysed in 6 areas: economy, innovations, customers, environment, communities

and employees.

Corporate social responsibility strategy:

|

|

|

Facing very high competition, ongoing pressure on our top line and the still significant

burden of our legacy, our strategy puts a lot of

emphasis on improving our efficiency on the

cost and capital expenditures side. We aim to

become a simpler and more focused company. The measures we take to achieve this are

both short term and long term.

Every year we undertake numerous actions to

save operating costs in all parts of our business. For a number of years we have been

delivering PLN 200-300 million of sustainable

costs savings per annum and our aim is to

continue this in the years ahead. The most

important source of the savings is labour. We

optimise employment on a continuous basis.

Over the past three years we reduced our

headcount by around 20%. The scale of reductions is always negotiated with our social

partners (there are 17 trade unions at Orange

Polska). The social plan currently in effect

covers the years 2016-2017. Based on this

plan we released around 1000 employees in

2016 and a roughly similar number is expected to leave in 2017. We see room for further

employment optimisations and we plan to negotiate new social plans. Apart from labour,

we optimise spending on IT services, network

maintenance, property expenses, promotion

and marketing and general expenses.

As a part of the strategic review that is currently ongoing we are analysing new initiatives that are expected to boost our efficiency

and make us a more efficient organisation.

These initiatives will focus on better reallocation of resources to growth pillars and priority

areas on one hand. On the other hand, they

will prioritise the simplification of internal processes including, among others, a reduction

in the number of processes and their variants,

automation, digitisation and more agile IT.

|