To illustrate Orange Polska performance we use financial and operational KPIs. We present them in a table below.

| KPI | 2016 Outlook and guidance | Performance | 2017 Outlook and guidance |

|---|---|---|---|

| Adjusted* Revenue | Revenue to be under pressure – relatively benign outlook for mobile likely to be offset by ongoing negative trends in xed and lack of infrstructure projects |  |

Mobile service impacted by new roaming regulations and uncertainty on pre-paid

Slower growth of mobile equipment sales Legacy revenue (PSTN, wholesale) in continued structural decline |

| Adjusted* EBITDA | PLN 3.15bn – PLN 3.30bn |  |

PLN 2.8-3.0bn |

| Adjusted* CAPEX | Around PLN 2bn, including up to PLN 600m on bre rollout (excluding any spectrum li- cences) |  |

Around PLN 2bn, including around 0.8bn on bre rollout

(>1m new households connectable in bre) |

| Adjusted*

OCF |

- |  |

- |

| Net debt/adjusted* EBITDA evolution | Not higher than 2.2x |  |

Not higher than 2.6x including potential EC ne payment |

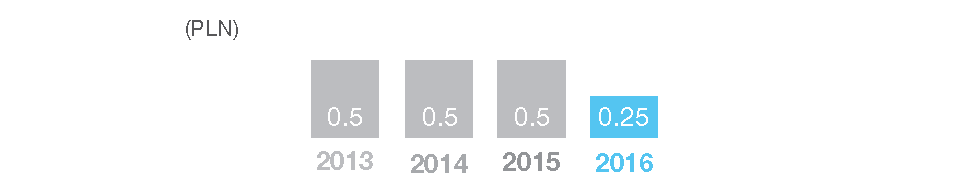

| DPS | 0.25 PLN to be paid in 2016 |  |

Management has decided to maximise cash allocation to strategic investment projects and therefore will recommend not paying any dividend in 2017* |

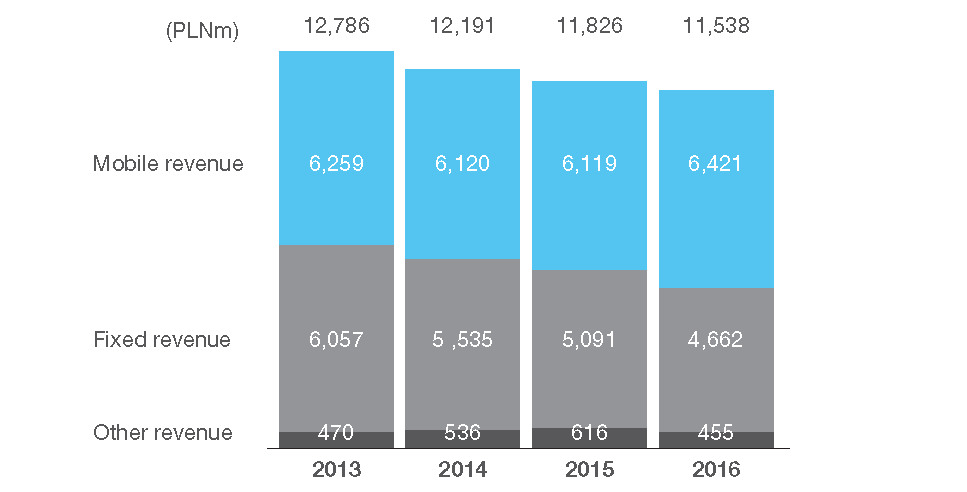

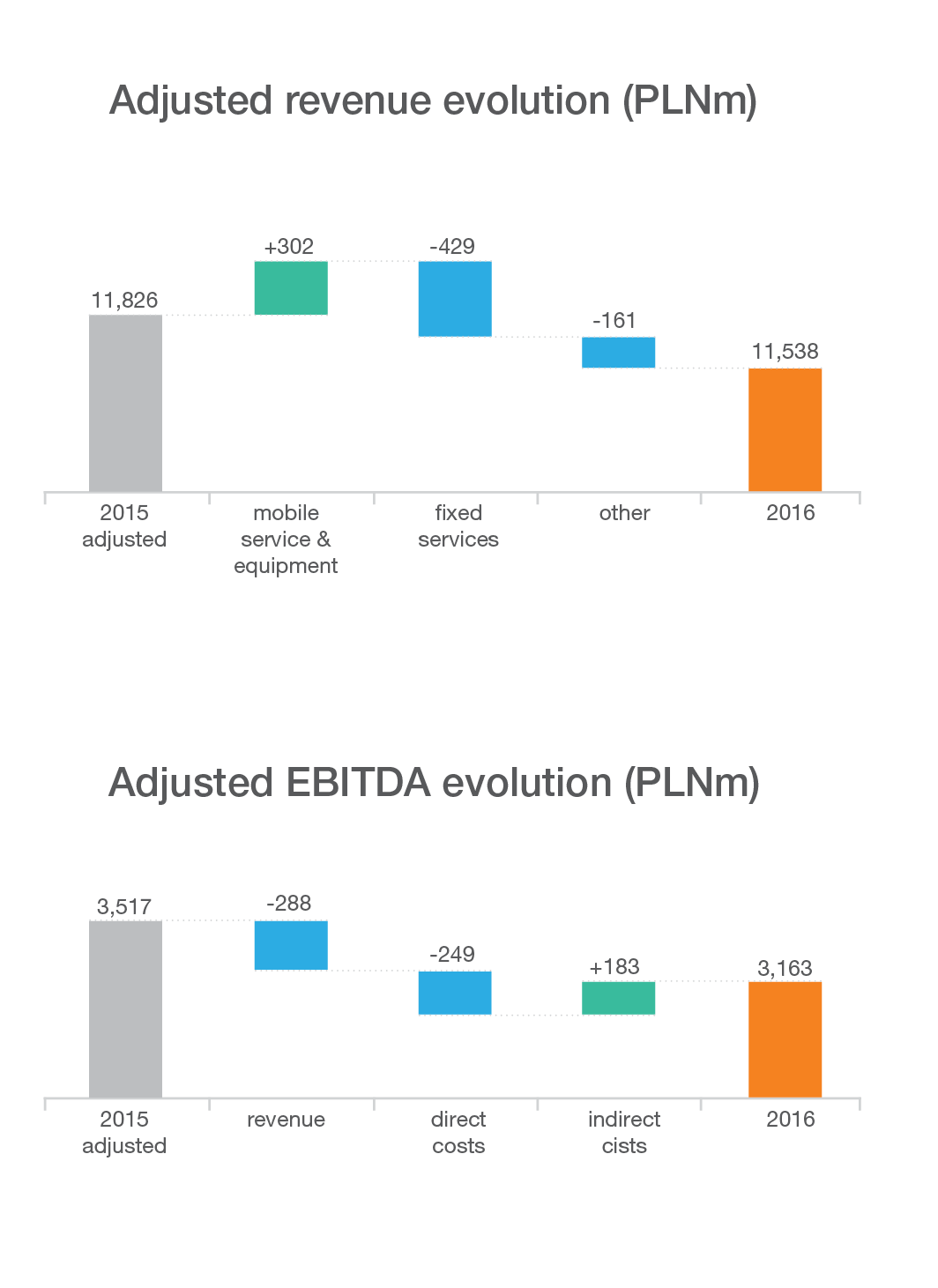

Adjusted revenue totalled PLN 11,538 million in 2016 and was down PLN 288 million (or -2.4%) year-on-year. The decline was slightlylower than a year before (- 2.9%). The decrease resulted from fixed line revenue erosion and much lower other revenue. In the fixed line segment, the decline affected mainly voice and wholesale services, which as legacy services are influenced by negative structural factors. Fixed broadband revenues were also down (by nearly 7%) due to a decline in both customer base and average revenue per user (ARPU). A 26% decrease in other revenue was mainly a consequence of the completion of broadband infrastructure projects, which in 2015 generated revenues of PLN 127 million. These negatives were partially offset by an increase in mobile revenues. This was supported by dynamic growth of mobile equipment sales (by nearly 70%), resulting from a strategic decision to focus on instalment sales in customer acquisition, while considerably reducing sales of traditional subsidised offers. On the one hand it stimulated rapid growth in equipment sales, but on the other hand it negatively affected retail revenues from mobile services (in the instalment scheme, a portion of revenue corresponding to the handset is reported as revenue from equipment sales rather than revenue from services). Blended ARPU amounted to PLN 28.4 in 2016 and was approximately 6% down yearon-year. The erosion was higher than in 2015 (4%). The trend slightly deteriorated in both post-paid and pre-paid services. The ARPU decline in 2016 can be attributed to the following factors:

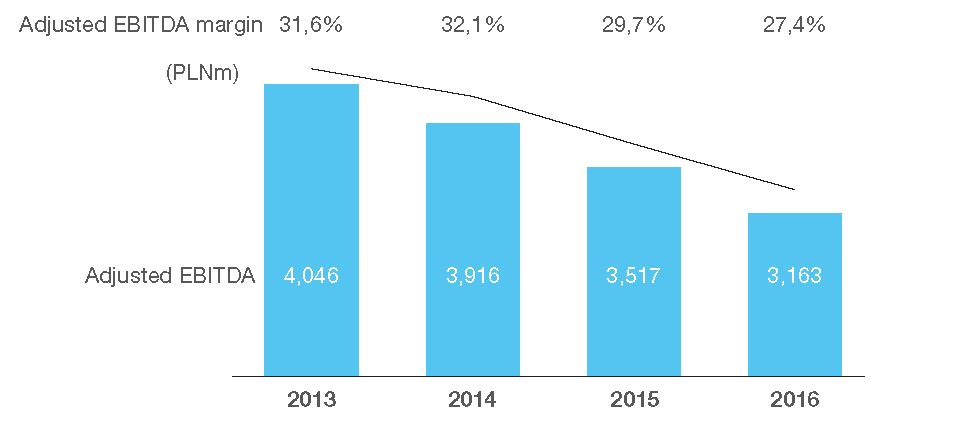

Total operating costs (determined as adjusted EBITDA less adjusted revenues) increased by less than 1% in 2016. As a result, the EBITDA erosion slightly outpaced the revenue erosion. Adjusted EBITDA margin decreased by 2.3 percentage points year-on-year and stood at 27.4%.

Our bottom line for 2016 stood at PLN -1,746 million versus PLN 254 million in 2015. It was heavily affected by PLN 1,793m non-cash asset impairment loss due to reassessment of future projected cash flows coupled with an increase in the discount rate to reflect higher business risk. Lower future cash flows are mainly a consequence of more conservative assumptions regarding performance on the mobile market, uncertainty in pre-paid, continuous deterioration in the legacy business and falling competitiveness of ADSL. It was also impacted by lower EBITDA and higher net financial costs (PLN 68 million above 2015), mainly as a result of higher debt.

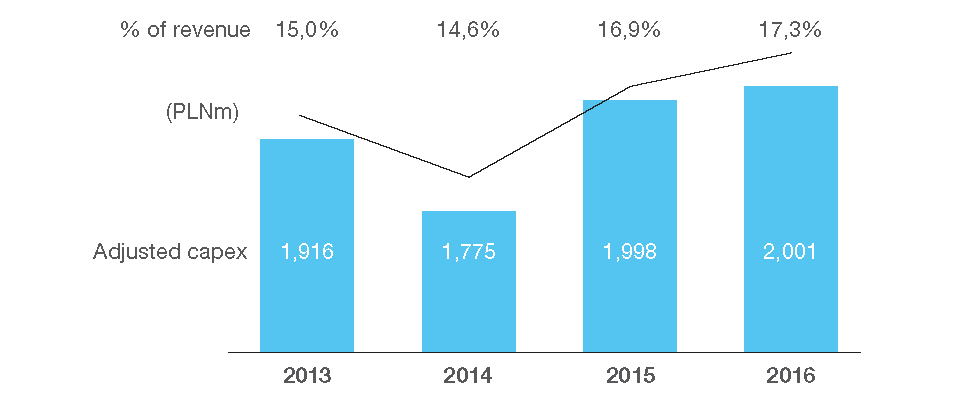

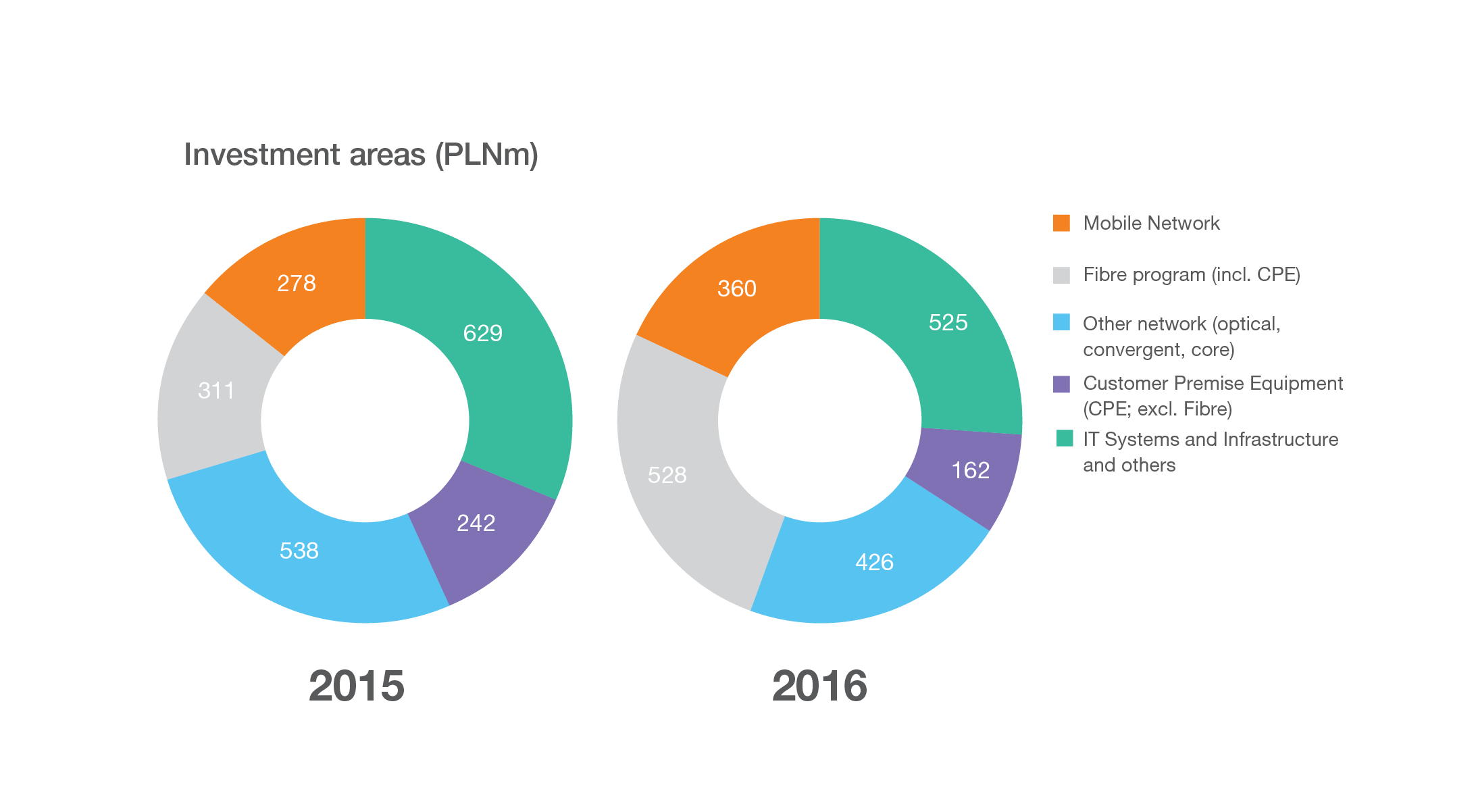

Our adjusted capital expenditures in 2016 (amounts excluding spectrum payments) amounted to PLN 2,001 million and were almost the same as in 2015. The only two growing capex categories are those related to investments in connectivity: mobile network and fibre network. Capex in all other areas was optimised to give clear priority to the key strategic projects.

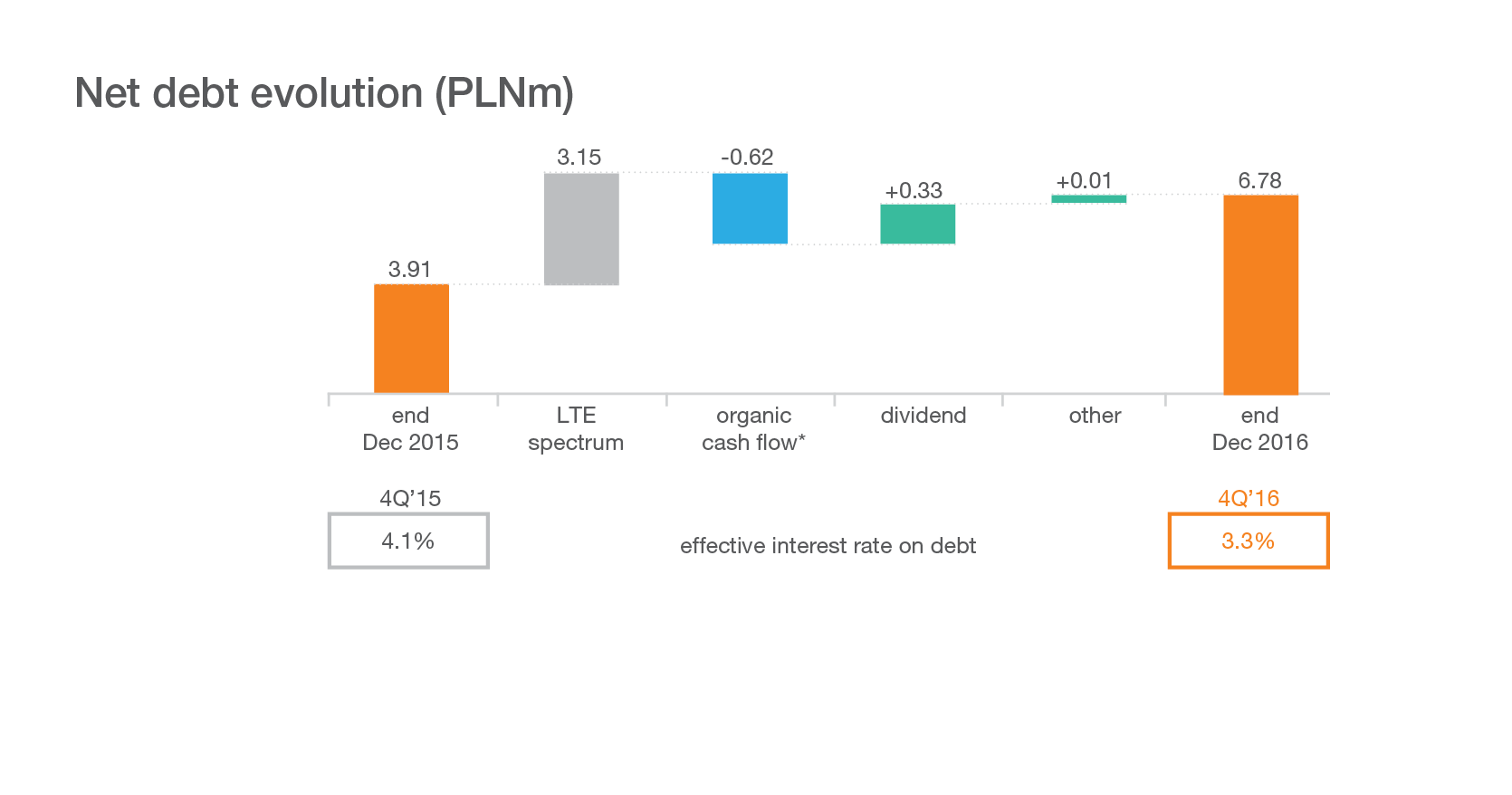

Our net debt in 2016 increased by around PLN 2.9 billion, to PLN 6.8 billion due to the PLN 3.15 billion payment for mobile spectrum. As a result of this, combined with lower EBITDA, we finished the year with a leverage ratio of 2.1x. Our debt was fully hedged against currency movements and was 70% based on the fixed interest rate.

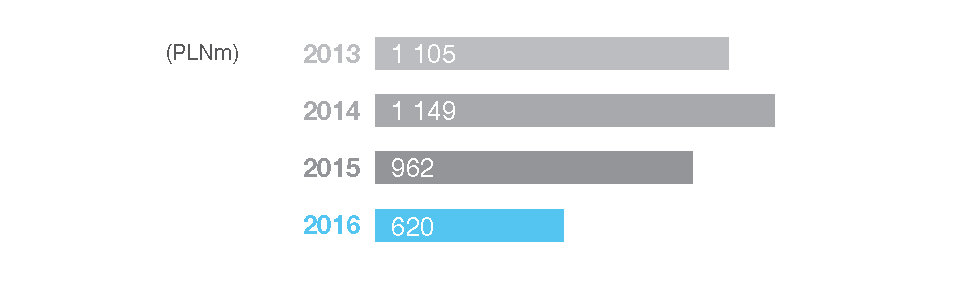

We are aware how important sustainable returns are for our shareholders and consequently we have been remunerating our shareholders for several years in a row. However, taking into consideration pressure on cash generation in 2017 and potential payment of EC fine, Management Board has decided that in the best interest of our shareholders we should allocate all financial resources into our transformation plan, specifically in fibre, and therefore will recommend not paying any dividend in 2017