| Profiles of Management

Board members |

| Our approach

to corporate governance |

| Our governance

structure |

| Orange Polska governing

bodies’ activities in 2016 |

Jean-François Fallacher (born in 1967)

Jean-François Fallacher (born in 1967)

Mariusz Gaca (born in 1973)

Mariusz Gaca (born in 1973)

Bożena Leśniewska (born in 1965)

Bożena Leśniewska (born in 1965)

Piotr Muszyński (born in 1963)

Piotr Muszyński (born in 1963)

In September 2008 he was appointed Member of the Management Board in charge of Operations, in November 2009 - Vice President in charge of Operations. Since 2016 he is Vice-President of the Management Board in charge of Strategy and Transformation in Orange Polska.

Career experience: In Orange Polska (former Telekomunikacja Polska) since 2001, initially as Director of Customer Care; 2005-2006 as Director of Sales & Services; 2006-2008 as TP Group Executive Director in charge of Sales & Services. In recognition of his career achievements he was awarded, among others: as the Manager of the Year in 2010 and 2011 with the Golden Antenna Award of the World of Telecommunication; with the Gold Cyborg award during the National Symposium on Telecommunications and ICT in 2011 – for his outstanding contribution to the development of information society. Bruno Chomel (born in 1968)

Bruno Chomel (born in 1968)

Witold Drożdż(born in 1974)

Witold Drożdż(born in 1974)

Magdalena Hauptman (born in 1968)

Magdalena Hauptman (born in 1968)

Jolanta Dudek (born in 1964)

Jolanta Dudek (born in 1964)

Jacek Kowalski(born in 1964)

Jacek Kowalski(born in 1964)

Maciej Nowohoński (born in 1973)

Maciej Nowohoński (born in 1973)

Piotr Jaworski(born in 1961)

Piotr Jaworski(born in 1961)

Jarosław Starczewski (born in 1972)

Jarosław Starczewski (born in 1972)

Mariusz Gaca (born in 1973)

Mariusz Gaca (born in 1973)

Orange Polska encourages shareholders to play an active role in the Company’s corporate governance. Shareholder consent is required for key decisions, including: the review and approval of the financial statements and Management Board Report on Activities; the review and approval of the Management Board’s recommendations on dividend payments or coverage of losses; the review and approval of the Supervisory Board Assessment of the Group’s situation; the election of the members of the Supervisory Board (and, if necessary, their dismissal); amendments to the Company’s Articles of Association; increase and reduction of the share capital; and the buy-back of shares.At the Company’s General Meetings, each share in Orange Polska entitles its owner to one vote. In addition to their participation in General Meetings, members of the Company’s Management Board and senior executives engage in active dialogue with the Company’s shareholders. To ensure that investors receive a balanced view of the Company’s performance, Management Board members – led by the President of the Management Board and the Chief Financial Officer – also make regular presentations to institutional investors and representatives of the domestic and international financial community

Orange Polska’s activity in the area of investor relations focuses primarily on ensuring transparent and proactive communication with capital markets through active co-operation with investors and analysts as well as performance of disclosure obligations under the existing legal framework. Orange Polska’s Investor Relations together with Company’s representatives regularly meet with investors and analysts in Poland and abroad and participate in the majority of regional and telecom industry investor conferences. Orange Polska Group’s financial results are presented quarterly during conferences which are available also via a live webcast. In 2016, the Company held four results presentations and over 200 meetings with investors and analysts in Poland and a number of other countries. Orange Polska’s activity and performance are monitored by analysts representing both Polish and international financial institutions on a current basis. In 2016, 21 financial institutions published their reports and recommendations concerning the Company. On March 2, 2016, CFO of Orange Polska answered retail investors’ questions during an investor chat held by the Association of Individual Investors (SII). Over 35 individual investors asked their questions during the chat. The key purpose of all efforts of the Investor Relations towards investors is to enable a reliable assessment of the Company’s financial standing, its market position and the effectiveness of its business model, taking into account the strategic development priorities in the context of the telecom market and the Polish and international macroeconomic environment. Orange Polska operates a website dedicated to investors and analysts at www.orange-ir.pl.

Corporate Governance in Orange Polska

is designed to provide responsible company management and supervision in order to

achieve the company’s strategic goals and

enhance its value. We have created a strong

corporate governance framework which

consists of mechanisms that help achieve

growth. Those mechanisms consist of structures, processes and controls which enable

the company to operate more efficiently and

mitigate risk. The ability of the company to

create value is ensured by having capable

governing bodies with a proper division of duwhich in turn enhance the decision making

process. Its structural elements, and the relationships between them, guarantee the transparency of key management decisions.

Orange Polska is fully accountable to its

stakeholders, and is committed to communicating its progress towards its business

goals and the fulfilment of its responsibilities.

We do this to increase confidence about our

company among investors, customers, suppliers, employees, governmental bodies and

the general public. We have paid the utmost

attention to constructing a corporate governance system which promotes ethical, responsible and transparent practices. By introducing these rules we are demonstrating the

company’s commitment to the highest standards of governance, and ensuring that these

standards will continue to stand up to scrutiny

by internal and external stakeholders.

Compliance with Warsaw Stock Exchange

Best Practice

Orange Polska S.A., as an issuer of securities listed on the Warsaw Stock Exchange, is

obliged to comply with the corporate governance practices set out in the guidelines, Best

Practice for WSE Listed Companies 2016.

In 2016, the company complied with this corporate governance best practice. However,

ties and optimal representation of experience,

skills and education. The sustainability of the

company is secured by the ability to allocate

fairly and sustainably the created value which

is necessary to the company’s long-term success.

The Management Board provides the leadership necessary to steer the company to

its strategic goals. It introduces policies and

rules for maintaining the internal cohesiveness of the organisation. All members of the

Management Board act as executives, while

the members of the Supervisory Board play

an oversight role. These two roles are separable and strictly assigned to these governing bodies. The Supervisory Board consists

of shareholders’ representatives, elected by

the General Assembly. In order to exercise its

obligations the Supervisory Board may at any

time examine any documents of the company, may demand from the Management Board

and employees any reports and explanations

and may check the financial standing of the

company. When necessary the Supervisory

Board may oblige the Management Board

to commission experts to draw up an expert

opinion for its use if a matter requires specialised knowledge or qualifications.

In order to ensure quality decision-making,

the Supervisory Board uses its committees

as advisory bodies. The members of each

committee are experts in their field of expertise who provide the Supervisory Board

with advice on issues requiring more detailed

analysis. The Audit Committee provides the

Supervisory Board with wide expertise on finance, accounting and audit. The Remuneration Committee deals with general remuneration policy and recommends appointments of

Management Board members. The Strategy

Committee is responsible for delivering recommendations on strategic plans and planning processes set up by the Management

Board.

The aim of the corporate governance model described above is to properly distribute

responsibilities within the company and establish the roles of the key governing bodies,

which in turn enhance the decision making

process. Its structural elements, and the relationships between them, guarantee the transparency of key management decisions.

Orange Polska is fully accountable to its

stakeholders, and is committed to communicating its progress towards its business

goals and the fulfilment of its responsibilities.

We do this to increase confidence about our

company among investors, customers, suppliers, employees, governmental bodies and

the general public. We have paid the utmost

attention to constructing a corporate governance system which promotes ethical, responsible and transparent practices. By introducing these rules we are demonstrating the

company’s commitment to the highest standards of governance, and ensuring that these

standards will continue to stand up to scrutiny

by internal and external stakeholders.

Orange Polska S.A., as an issuer of securities listed on the Warsaw Stock Exchange, is obliged to comply with the corporate governance practices set out in the guidelines, Best Practice for WSE Listed Companies 2016. In 2016, the company complied with this corporate governance best practice. However, ties and optimal representation of experience, skills and education. The sustainability of the company is secured by the ability to allocate fairly and sustainably the created value which is necessary to the company’s long-term success. The Management Board provides the leadership necessary to steer the company to its strategic goals. It introduces policies and rules for maintaining the internal cohesiveness of the organisation. All members of the Management Board act as executives, while the members of the Supervisory Board play an oversight role. These two roles are separable and strictly assigned to these governing bodies. The Supervisory Board consists of shareholders’ representatives, elected by the General Assembly. In order to exercise its obligations the Supervisory Board may at any time examine any documents of the company, may demand from the Management Board and employees any reports and explanations and may check the financial standing of the company. When necessary the Supervisory Board may oblige the Management Board to commission experts to draw up an expert opinion for its use if a matter requires specialised knowledge or qualifications. In order to ensure quality decision-making, the Supervisory Board uses its committees as advisory bodies. The members of each committee are experts in their field of expertise who provide the Supervisory Board with advice on issues requiring more detailed analysis. The Audit Committee provides the Supervisory Board with wide expertise on finance, accounting and audit. The Remuneration Committee deals with general remuneration policy and recommends appointments of Management Board members. The Strategy Committee is responsible for delivering recommendations on strategic plans and planning processes set up by the Management Board. The aim of the corporate governance model described above is to properly distribute responsibilities within the company and establish the roles of the key governing bodies, referring to the Recommendation IV.R.2 of the Best Practice guidelines, the company provides a live broadcast of the General Meeting but it provides neither real-time bilateral communication nor the possibility to exercise the right to vote for shareholders taking part in a meeting from a location other than the general meeting, due to legal risks involved in providing such electronic means of communication. The full text of our Statement on the company's compliance with the corporate governance recommendations and principles contained in Best Practice for GPW Listed Companies 2016 is available at http://orange-ir.pl/corporate-governance/best-practices

We are convinced that diversity of a company’s governing bodies is beneficial to the company's development. That is why we make sure that our Supervisory Board and the Management Board consists of people who are diverse in terms of age, sex, education and professional experience. Because they come from different environments and have a diversity of knowledge and skills, they can look from different perspectives at the management of the company and its efficient functioning in its markets

| General Assembly activities in 2016 |

The Annual General Assembly took place on April 12, 2016 in Warsaw. The Assembly adopted, among others, resolutions on:

The Annual General Assembly is convened by the Management Board (or by the Supervisory Board if the Management Board fails to convene it within the period set out by the law) and it is held within six months after the end of each financial year. The General Assembly is valid regardless of the number of shares being represented. The agenda of the General Assembly is determined by the body that has convened it. Any matters to be resolved by the General Assembly should first be presented by the Management Board to the Supervisory Board for its opinion. The resolutions are adopted by a simple majority of votes cast, unless the Commercial Companies Code or the Articles of Association provide otherwise. Voting at the General Assembly is open. A secret ballot is used at elections or upon motions for removal of the members of the company's Boards or liquidators, or calling them to account for their actions, or in personal matters. A secret ballot is also used whenever requested by at least one of the Shareholders or their representatives present at the General Assembly.

The Supervisory Board or the shareholders representing at least 5% of the share capital may request that particular matters be included on the agenda of the next General Assembly.

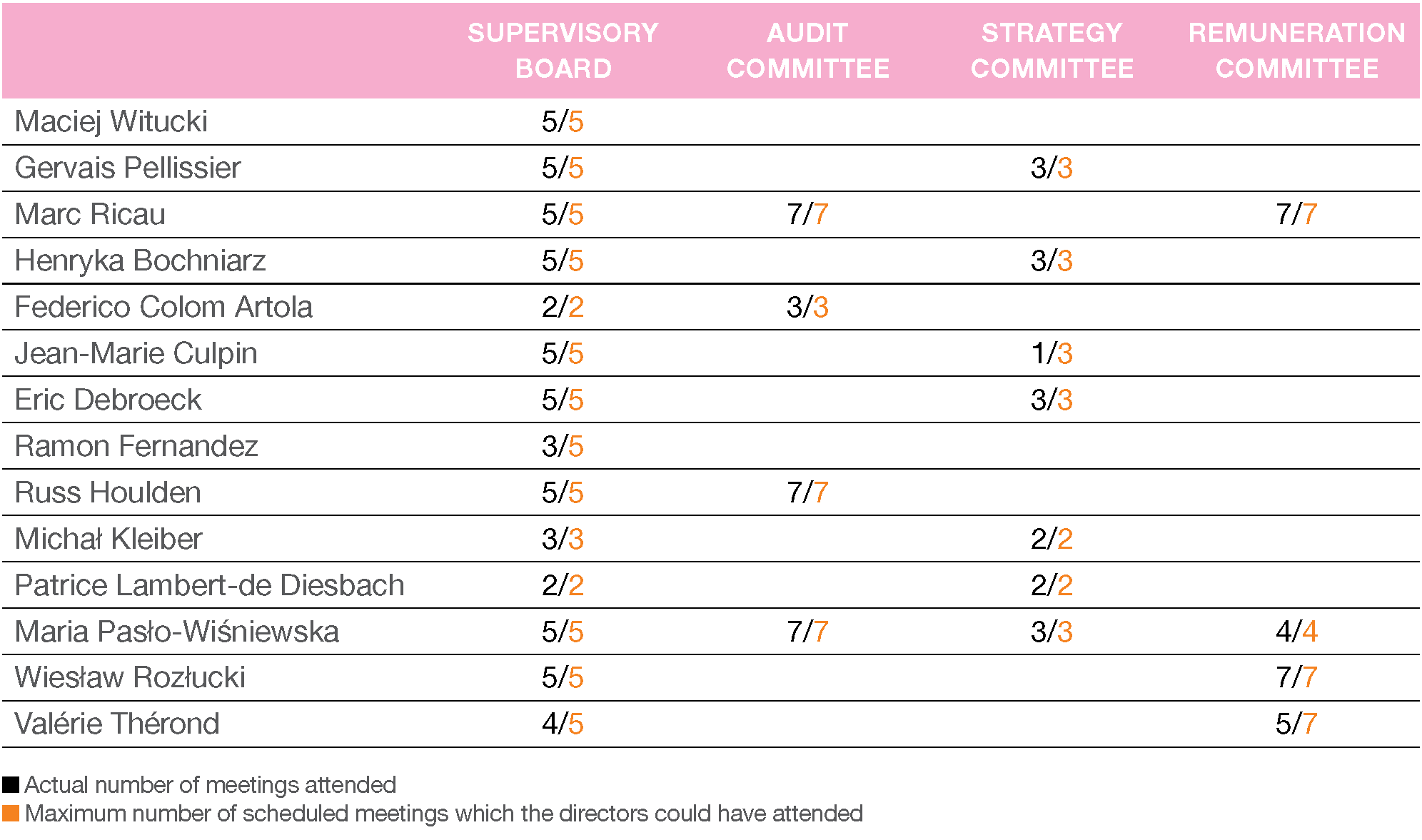

| Supervisory Board’s activities in 2016 |

| On the Supervisory Board’s agenda for 2016 |

| Assessment of Orange Polska Group’s Standing by the Supervisory Board |

The Supervisory Board, through the work of its committees and all its members (including five independent members), was actively engaged in the process of evaluation of the most important initiatives, having in mind the interest of all the Group’s stakeholders, including shareholders. In addition, it maintained oversight of the Group’s operational and financial goals through management reporting at its quarterly meetings and was able, through the Audit Committee, to review and challenge the control, risk management and budgeting functions performed by the Management.

| Audit Committee activities in 2016 |

One of the main responsibilities of the Audit Committee is to ensure proper financial reporting by the Company and Group. As part of this, we review all significant accounting judgements and estimates proposed by Management.

| Letter from the Chairman of the Audit Committee |

| On the Audit Committee’s agenda for 2016 |

As a response to operational and financial reporting risks, the Management implements internal controls at various levels of the organisation. The scope of these controls starts from, but is not limited to, transactional level controls, line managers’ or corporate reviews, trend analysis, reconciliation controls and goes up to the entity level controls. The aim is to provide reasonable assurance in safeguarding assets, detecting errors, the accuracy and completeness of accounting records, and the overall reliability of the financial statements.

The Management continuously monitors the evolution of the control environment. It ensures that all significant changes are sufficiently controlled and any identified deficiencies in the internal control system are addressed with action plans.

On a quarterly basis, Senior Managers certify the effectiveness of the internal controls in their areas of responsibility. On a yearly basis, the controls are subject to testing by the Internal Control team, Internal and External Auditors.

In 2016, the Management once again completed a comprehensive assessment of the Group’s internal controls over financial reporting. Any deficiencies identified were corrected or appropriate action points have been adopted. The Management concluded that there were no weaknesses that would materially impact internal control over financial reporting at December 31, 2016.

| Strategy Committee activities in 2016 |

| Strategy Committee members |

Mr. Maciej Witucki, Chairman of the Supervisory Board, and Mr. Russ Houlden, Independent Board Member and Chairman of the Audit Committee, participate in the meetings of the Strategy Committee on a permanent basis.

| On the Strategy Committee’s agenda for 2016 |

| Strategy Committee at a glance |

The Strategy Committee should meet at least twice a year. The Committee gives its opinions and recommendations to the Supervisory Board on the strategic plans set out by the Management Board, as well as any further suggestions to strategic plans made by the Supervisory Board, in particular concerning key strategic directions. The Strategy Committee may also provide recommendations to the Supervisory Board regarding Management’s planning processes. The Committee is consulted on all strategic projects related to the development of Orange Polska Group, the monitoring of the evolution of industrial partnerships within the Orange Polska Group and projects involving strategic agreements for Orange Polska Group. It then reports and makes recommendations on each of these projects to the Supervisory Board.

In particular, the Committee is invited to consider projects such as:

The issues submitted to the Strategy Committee contain, in particular, the information necessary for assessing the risks involved in these operations. Given the potential impact of these risks on the company’s accounts, the Chairman of the Audit Committee is entitled to attend the Strategy Committee meetings as permanent guest, along with the Chairman of the Supervisory Board.

| Remuneration Committee activities in 2016 |

| Remuneration Committee members |

| On the Remuneration Committee’s agenda for 2016 |

| Remuneration Committee at a glance |

The Remuneration Committee should meet at least four times a year. The task of the Committee is to advise the Supervisory Board and Management Board on the general remuneration policy of Orange Polska Group and to make recommendations on appointments to the Management Board. The Committee’s detailed tasks include:

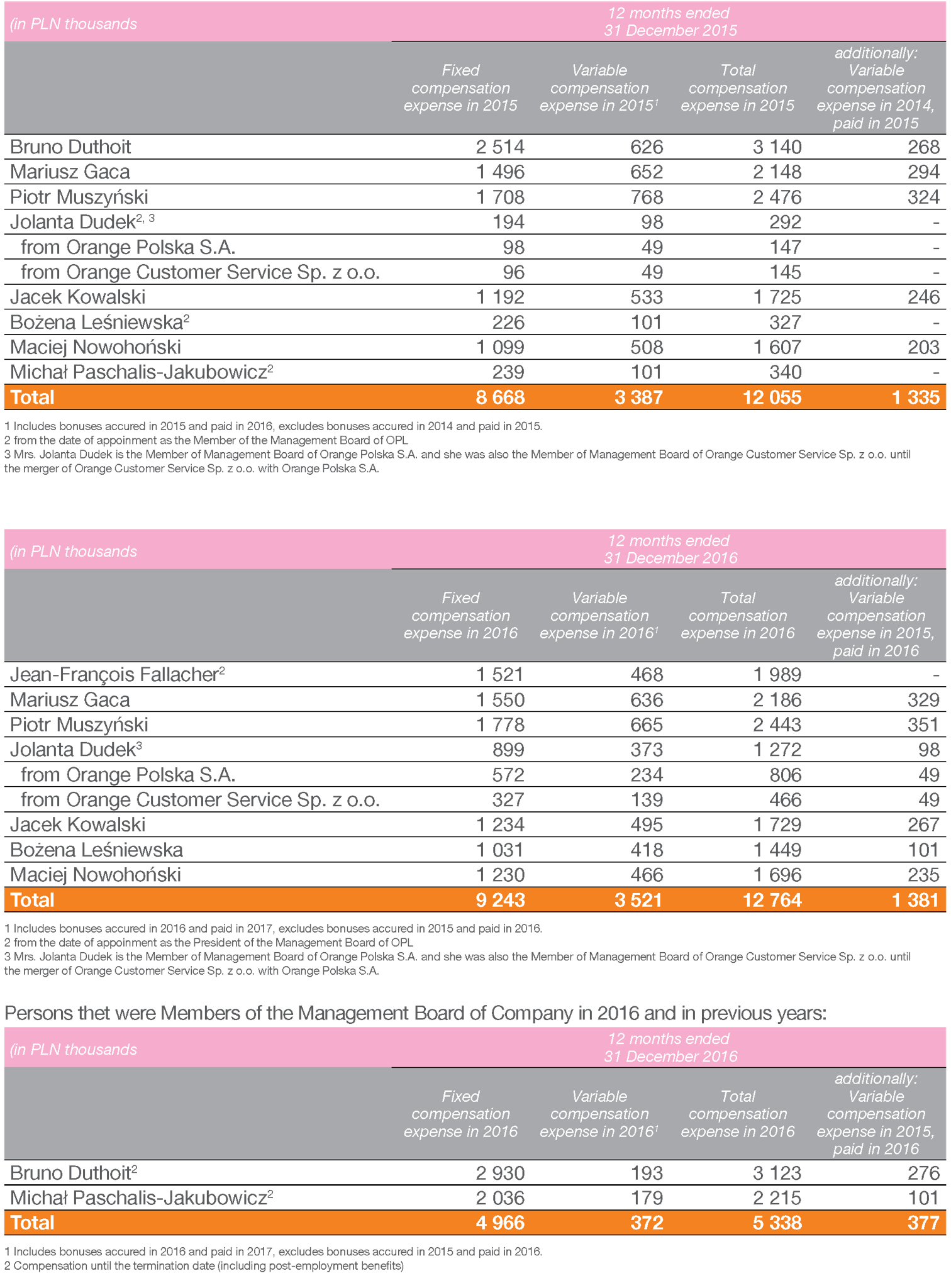

| Remuneration Policy of Orange Polska S.A. |

Orange Polska S.A’s strategy is based on

building and maintaining high levels of customer satisfaction, while providing a full range

of the best quality telecommunication, multimedia and specialised ICT services to suit

both household and business needs, as well

as offering extensive connectivity and high

standards of customer relationship.

The Remuneration Policy contributes to implementing the Company’s comprehensive

strategy. By enabling the recruitment, retention and motivation of the best managers and

professionals in the specialised areas that exist in Orange Polska S.A. it provides workforce

ready and able to achieve the Company’s

strategic goals. of.

Recognising that employees are a key asset

of the Company, the Policy supports the creation of favourable conditions in the digital

work environment. It promotes commitment

to the Company’s objectives, employee development and the use of flexible work methods.

Remunerations within Orange Polska S.A.

are compared to those offered by peer companies in the market. The remuneration level

depends on the Company’s financial results,

and on the employee’s individual contribution

and performance.

Remunerations are determined in a manner

ensuring balance and consistency across

the Orange Group. Our Remuneration Policy

complies with the labour law and corporate

governance regulations.

The remuneration system consists of the following components:

Employees leaving the Company under the

voluntary departure programme are offered

severance pay. The terms of severance pay

for employees are determined in a separate

agreement with trade unions in compliance

with the law, whereas the terms of severance

pay for those managers excluded from the

Group Collective Labour Agreement are settled in individual agreements and codified in

their employment contracts.

Terms of remuneration for Orange Polska

S.A.’s employees covered by the Group Collective Labour Agreement are determined in

co-operation with trade unions.

| Management Board’s activities in 2016 |