The Polish telecommunications market is subject to sector regulation established at EU level and transposed to national legislation. It is supervised by the National Regulatory Authority - Office of Electronic Communications (UKE). As a general rule the telecom market is divided into separate markets of wholesale and retail services (so-called "relevant markets"). UKE analyses the level of competition within each of these markets and, based on this analysis, decides on the necessary level of regulations. As an incumbent operator on the fixed services market, Orange Polska is designated an entity with significant market power and is subject to regulations in certain market segments. As such, this regulatory regime has significant impact on some of the services we provide. On the mobile market, regulations are equal for Orange Polska and other big market players.

As our services are provided to millions of customers, our activities are monitored by the Office of Competition and Consumer Protection (UOKiK), mainly with respect to adequate protection of customer rights.

We consider the following regulations to be the most important for our business at the moment:

Obviously as a business entity we must also comply with administrative decisions and general regulations. Recently the legal environment has been changing dynamically. For example, a change in the law that was originated outside of telecom sector and which has significant impact on our market was introduction of registration of pre-paid SIM cards in 2016.

The regulatory regime over the past few years has been evolving toward policy of balanced intervention. This is mainly related to changes in the structure of the overall telecom market in Poland and a much higher degree of competition in particular segments (e.g. emergence of cable operators as important players in retail fixed broadband). For example, in October 2014 UKE removed BSA regulations in 76 municipalities (mainly big cities), which corresponds to around one-third of the total fixed broadband market. New market analysis of wholesale broadband access (BSA and LLU) is expected this year. Also, at the beginning of 2017 UKE decided to deregulate SMS termination services.

At the same time UKE more often supports

regulatory policy that favours an investment

environment, moving from ex-ante regulations to ex-post verification, if a competitive

environment already exists. The potential

change in the regulatory framework that could

be expected is a change in Fixed Termination

Rate (FTR) calculation. UKE is working on a

new FTR costing model in order to implement

the European Commission recommendation.

When it is implemented, it will have a material negative impact on the revenue of Orange

Polska.

The changes to the roaming price regulations

have a negative impact on both revenue and

profitability of Orange Polska. This impact

was already visible in 2016 and will have further effects in 2017 and 2018.

Changes in the economy, such as GDP growth, inflation, unemployment levels, interest rates or foreign exchange rates, can influence our ability to create value. Whilst outside of our direct control, we can mitigate some of the potential adverse impact associated with market movements, such as interest rates and foreign exchange rates, through our hedging strategies.

In 2016, the Polish economy continued to grow, though at a slower pace than in 2015. GDP grew at a rate of 2.8%. The positive economic conditions resulted mainly from stable growth in private consumption, while slightly less favourable trends were reported in exports and investments. All these three growth engines should support the economy even better in subsequent years. Improvement in the labour market, growing wages, additional social transfers (especially the '500+' programme) and low interest rates will stimulate an increase in household expenditure, while export, which slightly slowed down in the second half of 2016, should rebound owing to recovery in the Eurozone. Poland's economic outlook depends on the condition of other European economies and the economic climate in global markets. According to economists mean consensus published in Bloomberg Poland's GDP is expected to grow 3.3% both in 2017 and in 2018.

Average annual CPI reached -0.6% in 2016, which was well below the inflation target (2.5%). Deflation, which took hold in the middle of 2015, resulted primarily from lower food, raw materials and fuel prices, which can be attributed mainly to external factors. Russian sanctions on EU food exports lowered demand for domestic food products, while a slump in oil prices in international markets contributed to a rapid decrease in fuel prices. Throughout the year, the Monetary Policy Council kept the reference interest rate at the record low of 1.5% (set in March 2015), upholding an opinion that the current stable economic growth limited the risk of inflation remaining below the target in the medium term. The expected increase in inflation will result from depreciation of the Polish zloty in case of a significant increase in risk aversion in global financial markets.

The labour market has been positively affected by the general macroeconomic climate, which was reflected in an increase in employment and a decrease in unemployment to 8.3% (-1.4 pp y-o-y) at the end of 2016. At the same time, an increase in wages in the enterprise sector was reported. Between January and December 2016, these wages were up 3.8% in nominal terms. A further improvement in the labour market, driven by growing GDP, enhanced the mood in the enterprise sector. Growing investments and inflow of EU funds can be expected in 2017.

2016 did not bring any changes in the Central Bank's policy and interest rates remained stable at a historically low level. It is expected that the reference interest rate will not change from the current level of 1.5% in 2017. However, a potential increase in interest rates should not have any major influence on the Group's debt service costs, due to the high hedging ratio.

Foreign exchange rate fluctuations affect Orange Polska's obligations denominated in foreign currencies and settlements with foreign operators. However, this influence is greatly contained by a portfolio of hedging instruments held by Orange Polska. In 2016, the Polish zloty lost 3.0% against the Euro and 6.4% against the US dollar. Polish currency fluctuations were caused by both internal and external factors. Due to outflow of capital from emerging markets and higher volatility in the currency market, it is not possible to clearly predict the Polish zloty trend in 2017. There is also considerable uncertainty as to changes in the economic policy seen in 2016. In the reported period, the exchange rate of zloty against euro was in the 4.2355–4.5035 bracket, while its exchange rate against the US dollar oscillated between 3.7193 and 4.2493. The National Bank of Poland's (NBP) mean exchange rates of PLN against the US dollar and euro were 3.9495 and 4.3637, respectively, in 2016.

The Polish telecom market is characterised by high levels of competition and relative fragmentation of players. It is mainly driven by mobile services and a high degree of fixed to mobile substitution in both voice and broadband. These factors have had a critical impact on the overall performance of the market in the past.

According to our estimates, between 2012 and 2016 the total value of the telecom market was declining at a pace of around 2% per year. Retail mobile service is by far the largest market segment with more than 50% share. The key factors that have influenced market performance in the recent years include:

Orange Polska has been affected by these trends relatively more than the overall market, which has been reflected in falling revenue. This was mainly due to:

We see the following key trends to drive the market in the years ahead:

We believe that the strategy adopted by Orange Polska makes it better equipped to capture positive trends than it was in the past.

There are two key aspects:

On the other hand we will be under further pressure from negative trends in legacy services and old technologies in fixed broadband. More details on our strategy are presented in strategy section on page 45.

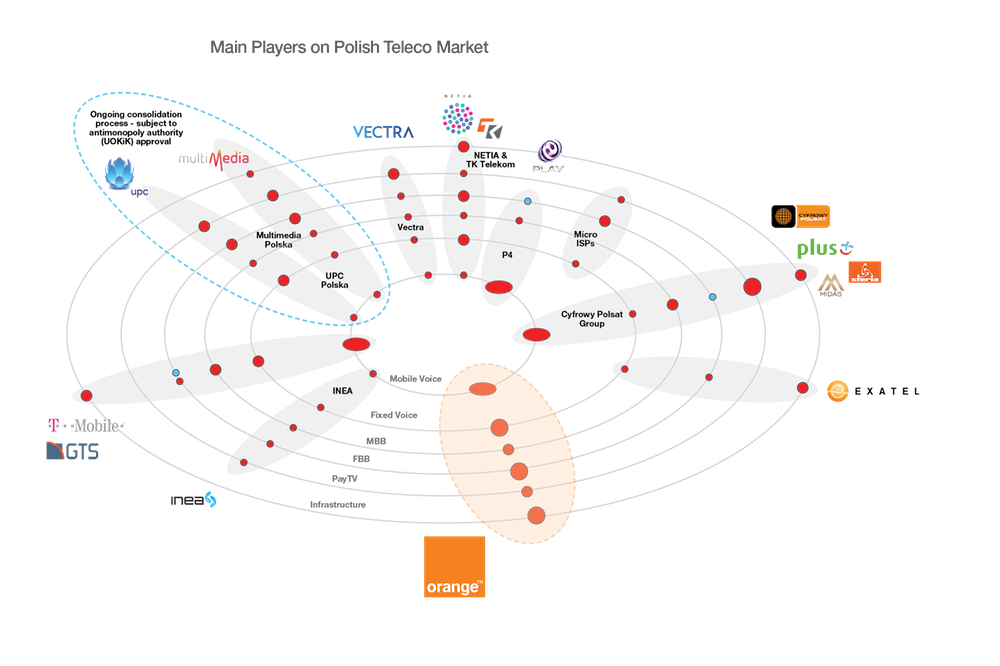

The Polish telecom market is fragmented both in mobile and fixed segments. So far, most consolidation is only taking place in fixed. Over the past five years the most notable transaction was the acquisition of the mobile operators Polkomtel by media group Cyfrowy Polsat in 2013. This created a media-telecom group focused mainly on bundling pay-TV and mobile services. Another major transaction – the acquisition of Multimedia (number 3 cable operator) by UPC (number 1 cable operator) – is currently in the approval process from the Office for Competition and Consumer Protection. If the transaction is finalised UPC's household coverage will jump by around 50%, which may encourage launch of convergent services in the future.

Orange Polska is the largest player present in all segments of the market and the volume and value leader in retail mobile services, fixed broadband and fixed voice.

The standard of living and the rate of employment in Poland have moved significantly closer to the EU average, but there is still a number of difficulties. Despite considerable successes, Poland's rate of employment at 56.3% is still lower than the EU average.

The rate of unemployment has continued to fall, reaching 8.6% in January 2017. However, Poland is still facing the problems of rapid ageing of its population and high emigration. The unfavourable demographic trends are already reflected in a decline in the working-age population. The percentage of elderly people in the entire population is expected to grow from 20.9% in 2010 to 58% in 2050 according to European Commission's Country Report Poland 2016.

There have been much progress in addressing inequality and poverty recently. The number of individuals affected by poverty or social exclusion has steadily decreased since 2008. However, Poland's social welfare spending has been amongst the lowest in the European Union, and social benefits, social insurance premiums and direct taxes have only slightly contributed to reducing poverty.

Digital exclusion is one of the factors leading to social exclusion. Internet access is nowadays not only a convenience, but often a precondition of full participation in the social, cultural and professional life. According to the Central Statistical Office (GUS), 80.4% of Polish households had access to the internet (and 75.7% had broadband connection) in 2016.

According to the latest Social Diagnosis, the key barrier in spreading the internet use is lack of motivation as well as lack of the relevant skills. Financial barriers are indicated as the reason for lack of the internet access by about 5% of households, while lack of technical opportunities at the place of residence is cited by just 0.5%. Thus, hard barriers (of financial or infrastructure-related nature) have decreased in importance. Finally, 15% of households believe that they do not need the Internet.

The use of the internet and modern technologies varies with social and demographic factors, especially age and education. The internet is used by a great majority of young people and very few seniors. The use of the internet is also related to wealth and the size of town, though the role of this factor has been declining.

Orange Polska is sensitive to global challenges related to the natural environment and natural resources. As a provider of telecommunication services we can significantly contribute to reducing the negative impact of business on the environment, so we incorporate initiatives to raise environmental awareness and respect for the environment into our business activities. Within environmental protection policy we supervise compliance of our operations with the law and other regulations regarding ecology.

We promote environmentally friendly solutions, which help to reduce greenhouse gas emissions through offering services that can replace traditional communications or written documents. Thanks to tele- and video-conferences, electronic document flow, online shopping, e-services, e-invoices and comprehensive ICT systems for business and administration, we make environmental protection part of everyday life. By the end of 2016, e-invoices had been adopted by over 5 million of our customers. In 2016, we saved 745 tonnes of paper by using e-invoices, thus saving 12 676 trees (or 26 hectares of forest). Our business activities influence the natural environment through generation of industrial waste such as electronic and electrical equipment, batteries and storage cells, cables and telegraph poles. The disposal thereof is closely controlled.