Until 2018 our financial results were in continuous decline for a number of years.

This was chiefly related to the following factors:

- Adjusting to a very high level of competition, mainly in mobile services, in order to defend market shares.

- Very high exposure to fixed-line telephony, which is being effectively substituted by affordable mobile services.

- Regulatory regime limiting flexibility in terms of shaping commercial offers.

Proper implementation of the Orange.one strategy was supposed to lead to the development of a business model that would enable us to break this negative trend and gradually return to sustainable growth. In 2018 our adjusted EBITDA increased year-on-year. This was the first growth after 12 successive years of decline. Our revenues continued to decline; however the trend visibly improved. In 2019 we sustained growth of EBITDAaL (EBITDA after leases – our new profitability measure, under new accounting standard IFRS16) and also grew our revenues, for the first time in 13 years.

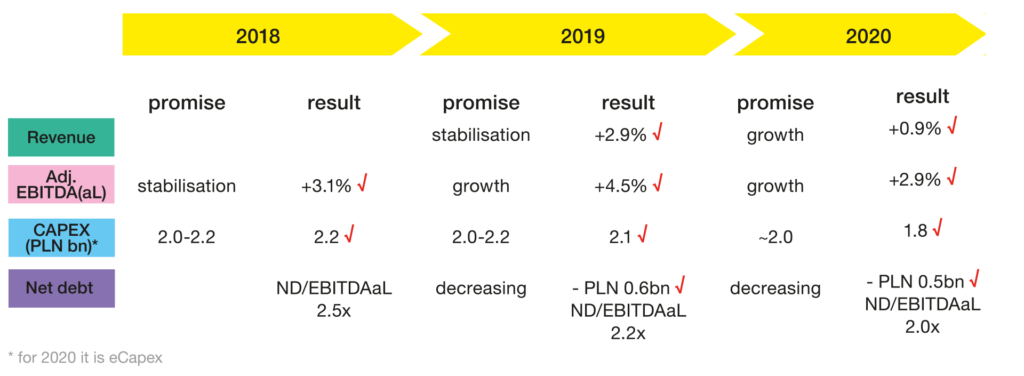

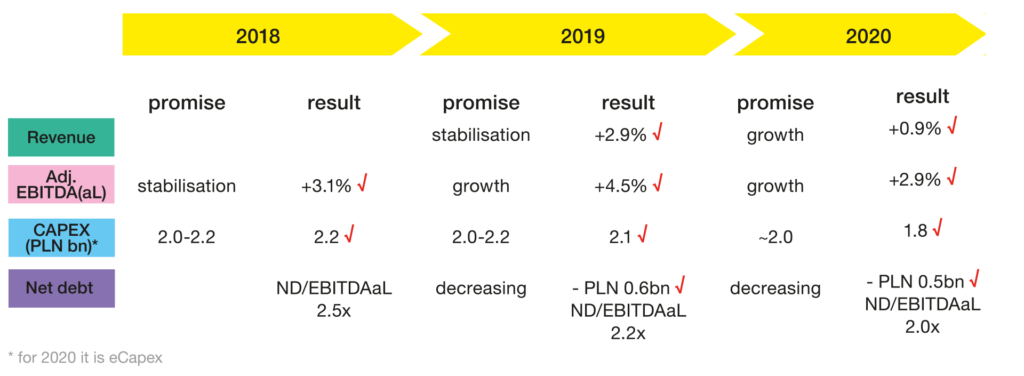

We have delivered on all of our financial goals set in Orange.one in each of year of the strategy. In some cases we even exceeded the initial expectations. Our revenues have been growing for the past two years and EBITDAaL for the past three years. We have kept capex within the limits and have significantly progressed with debt reduction.

Till 2017 Orange Polska was using IAS 18 accounting standard to recognise and to measure revenue.

Till 2017 Orange Polska was using IAS 18 accounting standard to recognise and to measure revenue.

In 2018, Orange Polska implemented the new accounting standard, IFRS 15. This standard changes the timing of revenue recognition for mobile contracts with subsidised handsets. Under IFRS 15, Orange Polska recognises more revenue upfront (as equipment revenue reflects the full value of the handset) and less revenue throughout the contract period (as service revenue is reduced by the amount of subsidy).

From 2019, Orange Polska is reporting its financial results under the new accounting standard IFRS16. The key objective of the new standard is to provide a single accounting method for lessees applicable to all lease contracts. Under IFRS 16, lessees recognise an asset in the balance sheet representing the right to use the leased assets in correspondence with the liability related to the lease obligations.

This change has been achieved through a combination of a progressive commercial turnaround and our focus on value coupled with great cost optimisation.

We have successfully implemented our convergent strategy, which was made possible thanks to the dynamic growth of fibre as monetisation of our considerable investments in this area has begun. A key element of this success was our particular attention to value in our commercial activities including ‘more for more’ price increases in mobile, convergence and fixed broadband. We also significantly developed the ICT area, which offers high growth potential and considerable synergies with our core telecom operations. These synergies have recently become higher than ever owing to ongoing digitalisation processes in enterprises. Over the last three years, we have increased our ICT revenues by 120%, mainly through organic development supplemented by acquisitions.

Simultaneously, we achieved very high cost savings. Since 2017 we have optimised indirect costs by almost PLN 600 million or 15%. This was done despite inflationary pressures in areas such as labour or electricity costs, so the effort to achieve the savings was even greater. Savings were generated across all cost groups, including labour, outsourcing, general and administrative, energy and network maintenance costs. They resulted from the comprehensive transformation of Orange Polska’s processes at each stage of our business model: networks, products and services, distribution and customer care. The process transformation aimed at simplification, automation and digitisation.

Operating profitability has been improving despite continued structural pressure on high-margin traditional fixed-line services, the erosion of which almost fully filters through to profits. The growing operating profitability has led to an increase in cash generation and a decrease in net debt and leverage ratio.

We reversed multi-year negative trends and delivered a financial turnaround