2019 was the second full year of implementation of the Orange.one strategic plan that we announced in September 2017, marking our new approach to long-term value creation. It represents an intensification of previous initiatives and articulates the Company’s strategic vision to 2020. Orange Polska aims to become Poland’s first choice telecommunications operator for consumers and businesses, at the same time as creating a business model that will generate sustainable growth in sales and profits.

We still derive a significant portion of our revenues and profits from services which once constituted the core of our operations and which have been in structural decline for a number of years. In order to offset this ongoing pressure on our revenues and create value, we need to invest in the development of business lines with growth prospects as well as exploring unique market opportunities. That is why we are investing heavily in the best connectivity and pursuing a convergence strategy. At the same time, we are radically transforming our operations to be more agile, digital and flexible, with a strong online presence and highly automated processes.

Moreover, we are also changing our internal culture. We want to work harder for the benefit of our customers; to be obsessed with improving their experience with Orange. Culture change at Orange Polska is also aimed at improving the work environment, so that our employees better identify with our goals and values, and gain confidence in their future careers with Orange. Last but not least, our value creation is reflected in our responsible approach to environmental and social matters. Our investments in connectivity make a substantial contribution to the development of Poland’s modern, digital society.

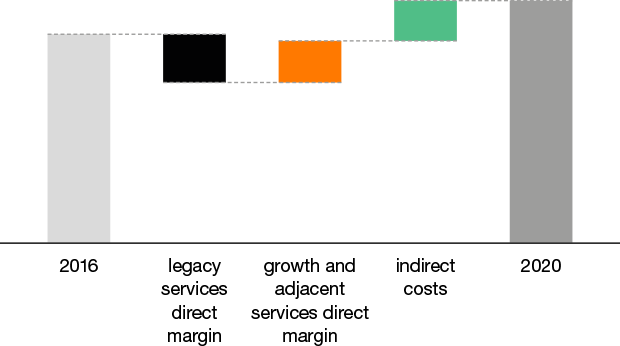

Adjusted EBITDA expected evolution 2016-2020*

* As presented in September 2017 during strategy announcement.

Convergent network

Customers want fast, reliable and safe broadband access, and from their point of view the technology by which the service is delivered is less important. It is our strongly held opinion that fulfilling customer needs requires first-class connectivity in both mobile and fixed. Mobile alone will not be sufficient. Fast fixed broadband is necessary to address the data demands of streaming services and heavier and heavier traffic, and at the same time to provide a desirable customer experience on the mobile network. In addition, a substantial part of our operations is dedicated to serving business customers who specifically cannot rely on mobile technology alone.

Fixed – from legacy to future proof fibre

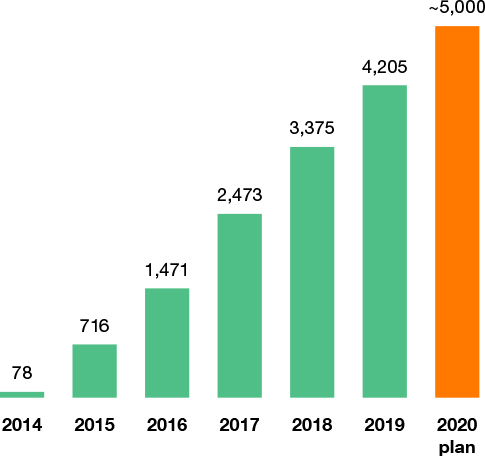

In 2015 we made a strategic decision to invest on a large scale in the deployment of a fibre to the home (FTTH) network. It is structurally improving our competitive position and gives us leverage to win back market share in densely populated areas. It also constitutes an important lever for our convergent strategy and one of the key enablers of our turnaround ambition.

We have completed five years of investments, bringing 4.2 million households within the range of the service at the end of 2019. We are on track to reach our goal of around 5 million households covered by the end of 2020. That number would include the vast majority of households in big cities and also a significant proportion of smaller cities. It also includes some households in more rural areas, where fibre access is covered by the government POPC programme (subsidised by EU funds).

Our FTTH network rollout strategy provides not only for the construction of our own infrastructure but also for wholesale agreements with other fibre network operators, where it is technically possible and economically viable. At the end of 2019 our network coverage included 670,000 households via the infrastructure of other operators.

In 2019 we covered around 830,000 additional households, broadly maintaining the very fast pace of deployment from the previous year. We plan to continue this pace in 2020. Last year we focused on smaller cities and also on single- family houses as opposed to multi-family residences. Single-family houses constituted as much as a third of total deployment in 2019. A substantial part of that deployment was carried out on other operators’ infrastructure. In total, at the end of 2019 single-family houses accounted for 10% of our total fibre footprint. On one hand, single-family houses carry a much higher construction cost; on the other hand, we notice far higher demand for our services due to much lower competition. The fibre service adoption rate in single-family houses at the end of 2019 exceeded 20%, compared to 12.4% for the whole fibre network.

To explore new opportunities and to better monetise our fibre investment, in 2018 we signed an agreement with T-Mobile granting wholesale access to our fibre network. The agreement covers around 1.7 million households located in deregulated zones, with access points built in multifamily residences on Orange Polska’s own infrastructure. The wholesale cooperation will contribute to faster monetisation of our investments in the fibre network, maximise usage of our infrastructure while avoiding fibre network overbuilding by other operators and accelerate convergence of telecom services in the Polish market based on fibre. The agreement is not exclusive. We maintain the right to offer the same terms of wholesale access to our fibre network to other operators.

We closely monitor our fibre network rollout with respect to monetisation: the number of customers and the value they bring. This depends mainly on the level of competition and our sales effectiveness. Investment in fibre is by nature long term, but in our view this is future-proof technology, the parameters of which can easily be upgraded if necessary. In particular, in 2019 we pursued a ‘more for more’ strategy for fixed broadband only and convergent services. The average price for a 24 month contract for the single broadband service was increased to PLN 59.99 per month, from PLN 54.99 previously. In return, the basic speed of the fibre service was increased to 300 Mb/s from 100 Mb/s. Higher speeds (600 Mb/s and 1 Gb/s) continued to incur additional charges (PLN 10 and PLN 20 a month, respectively). We also charge customers in single-family houses PLN 15 a month more to recover the higher deployment costs.

Fibre households connectable (’000)

Mobile – more spectrum on LTE

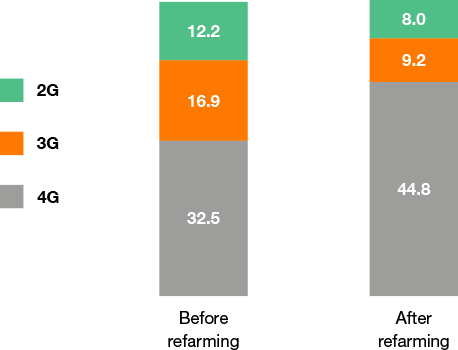

Mobile data traffic growth continues to be very robust. In total, traffic on our mobile network grew by 35% in 2019. To address this demand we continually invest in the quality of our network. By the end of 2019 our 4G/LTE mobile network reached almost the entire Polish population on an outdoor basis and almost 97% indoors. To accommodate robust growth of demand for LTE traffic, since 2018 we have focused on refarming the spectrum to allocate more for this technology and decrease the allocation for both 2G and 3G. This will allow us to use spectrum in a much more efficient manner and improve the customer experience. After completing refarming of the 900 MHz spectrum in 2018, last year we continued refarming 1800 MHz and 2100 MHz. At the end of 2019, work was finished on 88% of 1800 MHz sites and 81% of 2100 MHz sites. We plan to complete refarming by the end of first half of 2020.

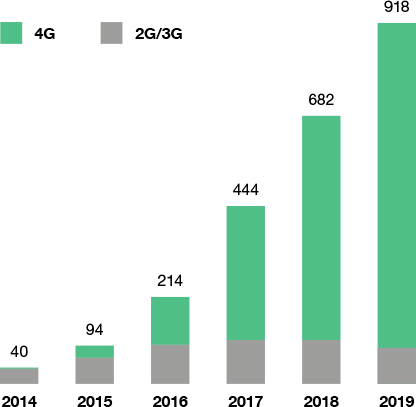

Allocation of mobile spectrum (MHz)

To strengthen network capacity we continue to pursue spectrum aggregation. Almost 80% out of over 11,000 LTE sites enabled carrier aggregation at the end of 2019, a significant advance on 2018. Around 2,600 of our base stations provide LTE technology on four layers of spectrum (800 MHz, 1800 MHz, 2100 MHz and 2600 MHz). In the years to come, 5G technology will become another important element of our mobile connectivity strategy. This will involve allocation of new spectrum, particularly in the 3.4-3.8 GHz band and 700 MHz. An auction for 3.4-3.8 GHz was scheduled for the first half of 2020. However due to COVID-19 pandemic it is likely to be delayed. The timing and formula for the allocation of 700 MHz is not yet clear.

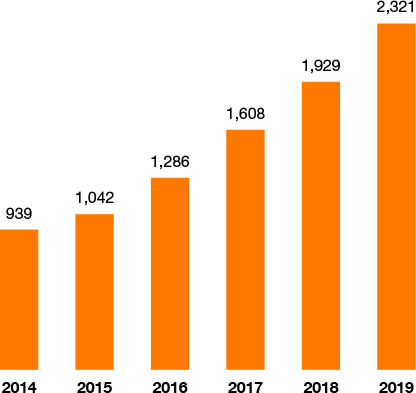

Mobile and fixed data consumption (PB)

Mobile

Fixed

We define ‘convergence’ as delivering a package of both mobile and fixed services, which fulfils the needs of an average household. In our view there is a significant potential for convergence in Poland as the vast majority of households still pay their media and telecom bills to different operators. Consolidation of these bills comes with both convenience and a financial benefit. We know from the example of some European markets (Spain or France) that convergence can be a winning commercial formula. In line with our value-focused approach, we made convergence our flagship product for Polish households. At the same time we limited advertising of our mobile-only or fixed-only offers.

Convergence gives us the following key benefits:

- It constitutes our competitive edge, a key market differentiator. On one hand, cable operators do not offer mobile services on any meaningful scale. On the other hand, our mobile competitors historically did not invest significantly in fixed access networks. That is now changing, with the acquisition of Netia by Cyfrowy Polsat and T-Mobile gaining access to our fibre network. However, our footprint to offer convergence on a fibre network is by far the largest in the market, and we believe Orange Love, as the only hard bundle offer, is a unique value proposition for Polish consumers.

- It is a good customer loyalty tool. Convergent customers tend to churn a lot less than non-convergent customers.

- It allows us to upsell more services, winning a higher share of household media and telecom budgets.

Orange Love – a winning convergent offer on the market

Our Orange Love convergent offer continued to be our flagship proposal for Polish households in 2019. The total number of B2C convergent customers increased 11% last year to 1.37 million. The Orange Love offer is a predefined set of fixed and mobile services, bundled together and sold at an attractive fixed price. The basic package can be extended with extra fees for additional SIM cards, higher fibre broadband speed and additional TV content. On top of that we offer a wide range of smartphones at attractive prices. Importantly, Orange Love is available on any broadband technology (fibre and copper), and also on LTE positioned as home broadband. This allows us to market this offer all over the country, which is very efficient. In March 2019 we refreshed the Orange Love offer. We designed two new packages called Extra and Premium to make the choice easier for customers looking for richer TV content.

TV content – an important success factor

An important factor in the success of our convergent strategy is the quality of TV content, which is very important for Polish consumers when choosing a service provider. In 2016 we changed the way we source our TV content, both on IPTV and satellite technology. It allowed us to be more flexible in the way we shape our offer and price it. In 2017 we became the first operator in Poland to launch a decoder that allows customers to watch 4K Ultra HD TV. Our TV offer is now fully competitive versus cable operators, allowing us to successfully build Orange’s reputation as a reliable content provider. We intend to remain a content reseller: our strategy does not foresee any investments in exclusive content. Our total TV customer base in 2019 increased by more than 5%, to approach 1 million. More than 80% of TV customers were convergent customers.

Building positive customer experiences

The customer is at the centre of everything we do. Therefore, we focus on building positive customer experiences as well as developing strong, long-term relationships, using modern digital channels. From portfolio development and process planning to customer care in all contact channels, we unite all our employees around the common goal of providing Orange customers with best experience.

For several years we have been assessing our customers’ experience with Orange through the NPS (Net Promoter Score) performance indicator. Our NPS is increasing gradually, which vindicates our complete focus on customers in all our activities. At the end of 2019, we had the second highest NPS score among telecom operators.

Approach driven by customer journeys

Our comprehensive customer experience management is based on customer journey management. For the purpose of customer experience design, we use modern methodologies – Customer Journey Design and Design Thinking – which account for customer needs, opinions and emotions.

In 2019, the key aspect in designing new and enhancing existing solutions for our customers was digitalisation. Some of the solutions implemented in 2019, which improved customer satisfaction through simplification, automation and digitalisation, are as follows:

- Max, our voicebot, answers 100% of customer calls to our main infolines. Its use of self-service systems, that is the percentage of issues which Max can resolve without a consultant, has been steadily growing. If contact with a human being is necessary, Max forwards the call to the right consultant; as a result, the number of internal call transfers between consultants has fallen by over one third.

- Chat – We expanded the scope of AI-based assistance to include text chat (chatbot Max).

- Robotic Process Automation (RPA) – This is a global trend and Orange is its leader in Poland. Further automation of customer care processes and implementation of innovative automated solutions (a bot/robot combination in customer care) have cut costs and improved operational efficiency by reducing time to complete, enhancing service quality and eliminating errors in business operations.

- We introduced new, clear and friendly invoice layout for customers of fixed, mobile and convergent services; a great majority of our invoices are delivered to customers in electronic form.

- We launched Orange Flex, the first fully digital offer supported by a chat in an application.

As a result of the implementation of digital tools in Orange outlets, first contact resolution in this channel doubled in 2019.

Customer centricity

We involve our entire organisation, from line employees to the Management Board, in reinforcing our customer-centric culture. Each key decision is considered in terms of customer benefits. The senior management regularly reviews customer satisfaction surveys, identifying the required actions. Such review meetings with the Management Board are regularly attended by special guests: customers, who share their experience with Orange.

All managers and selected experts regularly call customers who expressed their discontent in satisfaction surveys.

On a quarterly basis, all support function employees, together with technicians and couriers, have an opportunity to meet customers face-to-face in sales outlets or on infolines. In April 2018, we launched an internal e-platform for sharing knowledge and ideas about customer experience improvements. As a result, all employees can contribute their ideas for customer service enhancements, vote for others’ ideas, and participate in discussions. The best ideas are implemented.

In Orange, we attach great importance to constantly enhancing our processes. Therefore, each Orange employee has an opportunity to get involved in improving customer experience quality through participation in ‘Listen and Respond’ clubs, which adopt a constant improvement methodology. Almost 600 such clubs with a total of about 3,000 employees involved in improvement initiatives have been established so far.

Digitalisation: an increasingly important trend for our customers

Digitalisation is the key component of Orange Polska’s customer care strategy, as it provides customers with an opportunity for free selection, modification or discontinuation of services, and quick and easy self-service on a 24/7 basis. In particular, digitalisation involves automation, which brings significant savings for the Company and quality improvements for customers.

Previously, the main area of customer care digitalisation was the development of service channels on our website and in our mobile app. In 2019, we largely focused on using cutting- edge technologies:

- Robotisation of customer care and business processes: there were over 100 robots operating in Orange Polska at the end of 2019;

- Artificial intelligence: in 2019, our voicebot Max answered 100% calls on our main service infolines. Furthermore, we started to develop and implement AI solutions (chatbot Max) in our chat channel;

- Fully digital Orange Flex offer: with a dedicated application, customers can conclude an agreement with us, activate services using eSIM, and resolve any issues through self-service or chat.

Facing very high competition, ongoing pressure on our top line and the still significant burden of our legacy, our strategy puts a lot of emphasis on improving our efficiency on the cost and capital expenditures side. This area has been given new emphasis with the Orange.one strategy, which puts particular focus on value in all aspects of our activities. Our ambition is to be an agile company, digital and flexible, with a strong online presence and highly automated processes, as well as a proven ability to cut costs and find efficiency savings.

Direct profitability benefits from value focus

With Orange.one, we redefined our commercial approach. It is now much more balanced between volume and value. Orange Love convergent offers allow us to distinguish ourselves from the competition and reach our commercial goals more efficiently. We have significantly reduced handset subsidies and optimised our distribution channel mix, which is allowing us to improve direct profitability. To facilitate higher value generation we have simplified and aligned our commercial offers, both convergent and mono, around a ‘more for more’ approach, cutting down on value-dilutive offers and introducing charges for every additional service. Such a strategy assumes that the level of market competition remains high, but that competition will gradually be shifting from one based on price to one based on quality of the offer and customer service.

Transformation of processes

Our business model is a chain of interconnected processes that allow us to render our services. These processes are usually complex, which is partly attributed to the incumbent operator status of Orange Polska. Within the framework of Orange.one implementation we have introduced a comprehensive transformation program to simplify, and where possible to automate and digitalise these processes. As a result, we realise savings in operating costs and capital expenditures.

Ongoing indirect cost optimisations with a clear target

We have been optimising our indirect operating costs for many years, generating hundreds of millions in savings every year. We continue to do this under the Orange.one strategy. The savings come from the above-mentioned process improvements, which free up resources, as well as from volume optimisations and simplification. We are more focused and more selective in resource consumption. We tackle all cost categories presented in the chart below. As one of our Orange.one financial ambitions we committed to a 12-15% reduction of this cost pool (which amounts to around PLN 4 billion) between 2016 and 2020. This figure is net of potential increases related to inflation, pressure on labour costs and costs related to new business development. We reached this target 2 years in advance: in 2018 our indirect costs were 14% lower compared to 2016. In 2019 we delivered additional savings that bring the total level of reductions to 21%.

The largest cost category, and at the same time the most important source of savings, is labour. Over the past five years (2014-2019) we have optimised our employment by around a third, and we aim to continue. The scale of reductions is always negotiated with our social partners (there are 17 trade unions at Orange Polska). The social plan currently in force, signed in December 2019 and covering the years 2020-2021, enables us to continue with employment optimisation at a significant pace. According to the plan up to 2,100 employees may opt for voluntary departures in these two years, which constitutes 17% of the total workforce at the end of 2019. In 2020 1,250 people will be eligible to leave the company within the framework of this social plan. We are significantly optimising not only full-time employees but also outsourced employees. The annual average number of outsourced employees between 2016 and 2019 went down by 45%.

Indirect cost optimisations also include gains on sale of real estate. We have a large portfolio of real estate, mainly because of our long history. In the past we needed many more locations for our employees and our infrastructure. We are gradually consolidating office locations and optimising space for infrastructure. This process is supported by technological progress and changes in our business model. As a result, we are able to free up resources and sell unused real estate. This is a clear example of our discipline in capital reallocation: we are moving capital away from real estate into our fibre network deployment programme, which provides much better long term returns for the company.

Split of indirect costs for 12 months (through June 2017)*

In Orange Polska, we have been successfully implementing a policy of corporate business responsibility in all areas of our business for several years now. Our CSR strategy accounts for the Company’s business objectives and fits into their implementation. The conclusions from a dialogue with stakeholders as well as market trends and social challenges for our industry in Poland and abroad have been key elements in its development. For us, social responsibility means an organizational culture which takes account of the expectations of employees and other stakeholders’ groups – customers, investors, suppliers, business and social partners as well as the environment – in creating and implementing our business strategy. We believe that such an approach generates benefits for the Company and its environment, leads to long-term development and contributes to the improvement of everyone’s lives. Therefore, in Orange Polska we have created a social responsibility strategy which focuses on five areas which are of key importance from the point of view of our sector and our operations on the Polish market. In 2016 we launched the new CSR strategy for 2016-2020. It was updated in 2018. A strong foundation of this strategy is responsible management – our values, ethics and compliance and our dialogue with stakeholders as a tool for understanding their expectations. On this foundation are based four pillars of our CSR strategy:

- Social and digital development – We make new technologies an ally to economic and social development.

- Safe network- for the use of the latest technologies to be easy and risk-free

- Clean environment - to pursue our business objectives with respect for ecological principles and in harmony with the environment

- Engaged team – We build culture of co-operation in which employees feel respected, work towards achieving shared goals and have an influence on functioning of the Company.

Responsible management and actions within these four pillars account for our social impact, which is analysed in 6 areas: economy, innovations, customers, environment, communities and employees.

Key financial goal: return to sustainable growth of revenues and profits

Our financial results have been in continuous decline for a number of years. This is chiefly related to the following factors:

- The necessity to adjust to a very high level of competition, mainly in mobile services, in order to defend market shares

- Very high exposure to fixed line telephony, which is being effectively substituted by affordable mobile services

- Regulatory regime limiting flexibility in terms of shaping commercial offers

Proper implementation of the Orange.one strategy will lead to the development of a business model which will enable us to break this negative trend and gradually return to sustainable growth. The first two years of strategy implementation confirmed that we are on track. In 2018 our adjusted EBITDA increased year-on-year. This was the first growth after 12 successive years of decline. Our revenues continued to decline; however the trend visibly improved. In 2019 we sustained growth of EBITDAaL (EBITDA after leases - our new profitability measure, under new accounting standard IFRS16) and also grew our revenues, in line with our guidance.

* As presented during strategy presentation in September 2017

** Adjusted EBITDA growth under IAS18

Till 2017 Orange Polska was using IAS 18 accounting standard to recognise and to measure revenue.

In 2018, Orange Polska implemented the new accounting standard, IFRS 15. This standard changes the timing of revenue recognition for mobile contracts with subsidised handsets. Under IFRS 15, Orange Polska recognises more revenue upfront (as equipment revenue reflects the full value of the handset) and less revenue throughout the contract period (as service revenue is reduced by the amount of subsidy).

From 2019, Orange Polska is reporting its financial results under the new accounting standard IFRS16. The key objective of the new standard is to provide a single accounting method for lessees applicable to all lease contracts. Under IFRS 16, lessees recognise an asset in the balance sheet representing the right to use the leased assets in correspondence with the liability related to the lease obligations.

Sales revenues growth will be driven by the following factors: significant growth of convergent customer base and convergent services; continued focus on value in pricing; lower decline in non-convergent services; successful development in adjacent business areas (ICT, Orange Energy, sales of equipment); and a diminishing share of legacy services in total revenues.

The improving revenue trend will contribute to an improvement in the EBITDAaL trend, which will also be driven by operating leverage and continued cost optimisation. When we announced the strategy, we set ourselves a target to reduce underlying indirect costs by 12–15% by 2020 versus 2016. We reached this target already in 2018, and added additional savings in 2019. Savings are generated across all cost groups, including labour, outsourcing, general & administrative, energy and network maintenance costs. They result largely from the comprehensive transformation of Orange Polska’s processes at each stage of our business model: networks, products and services, distribution and customer care. The process transformation aims at simplification, automation and digitisation. Cost optimisations are also facilitated by sales of unused real estate. We are gradually consolidating office locations and optimising space for infrastructure. This process is supported by technological progress and changes in our business model. As a result, we are able to free up resources and sell unused real estate.

Projected capex reflects our connectivity programme and business transformation needs. Our capex ambition is to spend at least PLN 2 billion annually by 2020, including around PLN 2.8 billion on fibre network deployment in 2018–2020, to cover more than 5 million households by the end of 2020.

Outlook for capital expenditures (in PLN bn)*

* As presented in September 2017 during strategy announcement.